Governments worldwide are prioritising resilience, reliability, and efficiency in their policies. For example, Germany’s new coalition government has committed €1 trillion over the next decade toward defence and infrastructure modernisation, aiming to boost the country’s resilience amid global instability.

In the US, despite a focus on reshoring manufacturing under the Trump administration’s [1] trade policies, the broader goal is enhancing domestic supply chain resilience and national strength.

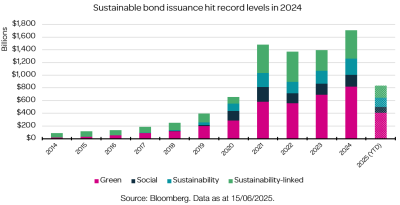

To gauge the momentum behind sustainability-driven investments, we track the issuance of Green, Social, Sustainability, and Sustainability-linked bonds (GSSSB), which reflect capital allocation aligned with these priorities.

With lending terms for these types of bonds explicitly linked to the use of proceeds, capital raised via these bonds will almost certainly be directed towards sustainable development projects.

Green bonds are the most well-known example as they have established rules and requirements with regards to the type of projects they can fund. Examples include projects providing energy efficient technologies, financing new low carbon energy infrastructure, or funding water infrastructure projects.

Looking back, the Inflation Reduction Act – President Biden’s flagship climate financing initiative didn’t unfold as initially expected.

In response, we have adjusted our investment strategy to capture growth by diversifying across companies’ capital structures, from equity to fixed income. This approach preserves our sustainability goals while enhancing financial outcomes.

Based on recent lessons, we believe the best risk-adjusted equity opportunities lie in well-established, highly profitable businesses that do not rely heavily on government subsidies to deliver strong returns. This offers a margin of safety, as their investment cases are solid even without factoring in government spending.

These companies tend to be larger and align closely with our investment approach, aiming to deliver performance comparable to traditional portfolios.

As a result, they are often overweight in our most ambitious portfolios. Beyond equities, labelled bonds form a significant part of our fixed income allocation. These bonds offer characteristics like non-labelled bonds and behave predictably, providing access to sustainable projects without added risk.

Examples include multi-lateral development bank bonds, green bonds, and social bonds, all of which are included in our portfolios.