ESG (Environmental, Social, and Governance) factors provide investors with critical insights into the non-financial risks and opportunities that can affect a company’s long-term performance.

These cover a wide range of issues – such as environmental practices, data security protocols, and executive compensation structures – that may not be captured in traditional financial analysis but are nonetheless vital to understanding a company’s overall risk profile and strategic alignment.

While sometimes harder to measure, these factors are materially relevant and should be integral to any investment decision. Extensive academic research supports the value of ESG integration, with many studies showing that companies with strong ESG practices tend to deliver better long-term returns. These companies are often better equipped to avoid reputational damage, financial penalties, and regulatory breaches, all of which can undermine shareholder value.

ESG leadership, therefore, not only supports sustainability goals [1] but can also enhance corporate profitability and investment performance.

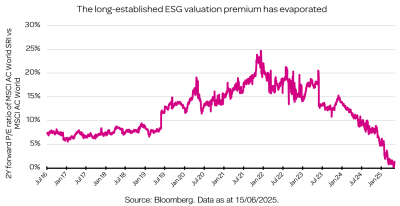

Historically, companies with strong ESG credentials have been viewed as higher-quality investments, often commanding a valuation premium due to their superior risk management and long-term resilience. However, over the past year, this ESG premium has nearly disappeared – posing a headwind for sustainable investment returns over the last 18 months.

This decline in ESG focus is partly linked to geopolitical and political developments. Since Russia’s invasion of Ukraine, investor attention to ESG factors has waned, and in the US, political and regulatory pushback – especially under the current Trump administration [2] – has created pressure on ESG-leading companies. Critics argue that ESG initiatives, like voluntary climate or diversity targets, raise costs and hurt short-term profits, clashing with the long-term perspective of sustainable investors.

Despite this sentiment shift, the real-world corporate response tells a different story. Many CEOs continue to uphold ESG commitments, albeit with less public emphasis – a trend referred to as ‘greenhushing.’

Ultimately, we believe that ESG is still materially relevant to company performance. If the ESG valuation premium stays low, this creates a unique opportunity for sustainable investors to build portfolios of resilient, lower-risk companies at market-level valuations – effectively gaining long-term risk protection at no extra cost.

Investing in ESG leaders, therefore, is still a sound strategy for those focused on future-proofing their investments.