A team of 15 people have embarked on a scientific experiment whereby they have agreed to live in a cave for 6 weeks. Now in situ in the vast Lombrives cave complex in the Pyrenees mountains south of Toulouse, France, the team have no access to watches, phones, or natural light. The aim of the experiment is to study how the human body copes with no way of telling the time. After more than a year of being cooped up in a flat, rarely leaving to go outdoors and not seeing much sunlight, I could probably help the experiment’s organisers…

There was light at the end of the tunnel for Growth investors last week as US treasury yields begun to stabilise after their biggest upward move since 2018. This comes as the US Federal Reserve reiterated its stance that it would keep interest rates low and stimulus programmes in place even in the event of rising inflation. But while investors are increasingly optimistic about a US economic recovery, it’s a far grimmer picture this side of the Atlantic.

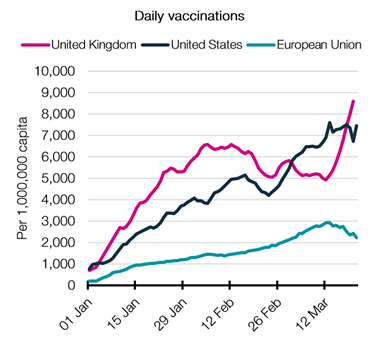

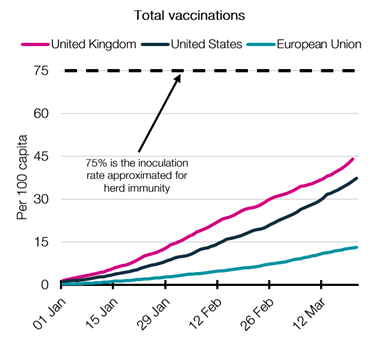

Despite being perceived as having poorly handled the early stages pandemic by its national press, the UK government has seemingly begun to redeem itself through an impressively efficient vaccine roll-out. As a result, the UK has emerged as one of the leaders in vaccine roll-out globally and is well on the way to achieving the 75% inoculation rate estimated to achieve herd immunity. This has led to the UK government publishing a roadmap out of lockdown in what is hoped to be a final move towards normality. Encouragingly, the US is in a similar position to the UK with a vaccination rate that is approaching nearly 40% of its population. However, the roll-out on the European continent is somewhat more worrying.

| Figure 1. The UK and the US have led the charge in rolling-out vaccines while the European Union has lagged | Figure 2. Shortages of vaccine and a knock to public confidence will pose further challenges for the European roll-out |

|

|

| Source: Our World In Data, EQ Investors | Source: Our World In Data, EQ Investors |

Following a series of delays and setbacks to the procurement, the authorisation and the production of vaccines, the European Union has struggled to keep up with the UK and the US. Indeed, while daily vaccination rates are now at or around record levels for the UK and US, daily rates are declining in many European countries. The real headline-grabber, however, has been the clash between the European Commission and British pharmaceutical giant AstraZeneca as the two parties have sought to blame each other for the lack of supply in the European Union.

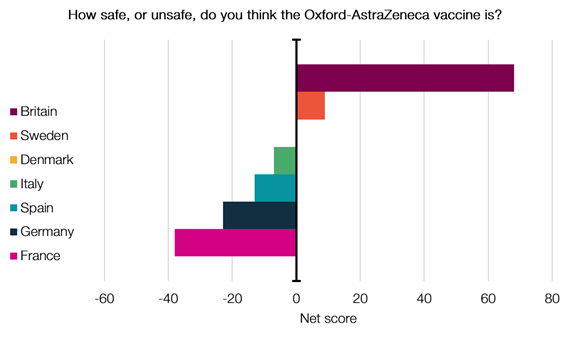

To make matters worse, several European governments have offered conflicting advice for who is eligible for the Oxford/AstraZeneca vaccine, and some have even temporarily halted use of the shot following speculation that the vaccine was linked to a rare type of blood clot. This claim has since been strongly rebuffed by the drug maker AstraZeneca, the European Medicines Agency, and the UK’s Medicines and Healthcare products Regulatory Agency, and has now also been dismissed by a mass trial of the drug in the US. Unfortunately, conjecture around the vaccination’s safety has already led to a knock in public confidence across the continent with many already vaccine-sceptic countries taking an increasingly negative view on the jab despite and large amounts of the vaccine sitting unused in fridges.

| Figure 3. A YouGov poll has recently shown public confidence in the Oxford/AstraZeneca vaccine is increasingly negative in Europe, a view that is not helped by conflicting messages from national governments |

|

| Source: YouGov, EQ Investors |

Having already rowed back once from the threat of blocking vaccine exports to the UK, renewed threats emerged in the press over the weekend that the European Commission is once again considering implementing an export ban. If this report is true, it could spell untold trouble for the West as countries descend into vaccine nationalism, overlooking the need for international cooperation and delaying economic recoveries and returns to social normality. This would also undoubtedly have grave consequences for West’s influence internationally at a time when tensions with China and Russia and flaring.

STAT OF THE WEEK: 15 – the number of cases of deep vein thrombosis out of the 17 million people who have had the Oxford/AstraZeneca vaccine (AstraZeneca).

Data correct as at: 21/03/2021

Contact us

Have a question about investing with EQ? Please email enquiries@eqinvestors.co.uk or call 020 7488 7171, we’re always happy to hear from you.