A Missouri man has credited a well-timed phone call for leading him to a scratch card jackpot of $2 million. Rudy Mendez told lottery officials that he had received the phone call and stopped off at a convenience store to safely answer the phone. While pulled over, he went into the store and bought the scratch card which led to the jackpot win.

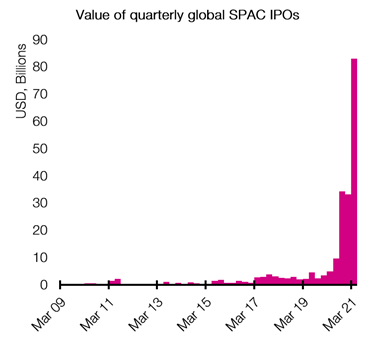

Equities were also saved by the (closing) bell last week as the S&P 500 finished their Friday session at a fresh record high. One trend we’ve seen explode in the year to date has been that of the SPAC: the special purpose acquisition company. Normally when a company raises money through an initial public offering, they must open their accounts, provide financial information, and present a business plan, which can be a laborious and costly process. With a SPAC, however, money is raised in the public markets on the promise that it will be used to acquire a stake in a business, thereby allowing private companies what is termed a “backdoor listing”.

Put simply, a public company (the SPAC) merges with a private company and the shares of the newly combined company continue trading on the market thus streamlining the listing process. These types of listings have become incredibly popular in the last year, with several high profile individuals backing their own SPACs, ranging from top bankers and hedge fund managers to business tycoons like Richard Branson.

While the concept of a SPAC has been around for decades, 2020 turned out to be a bumper year for listings of these so called blank cheque companies with around $82 billion raised throughout the year. However, the first quarter of 2021 (which is not yet even over!) has already topped last year with a little over $83 billion raised year-to-date! So, what has been driving this trend?

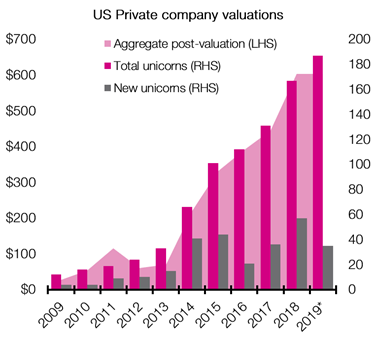

| Figure 1. SPAC IPOs have exploded over the last year as investors give blank cheques to sponsors | Figure 2. With unicorns (companies with a valuation over $1 billion) staying private for longer, some argue that the prestige of a market listing isn’t worth the cost |

|---|---|

|

|

| Source: Bloomberg, EQ Investors | Source: PitchBook, EQ Investors |

One contributing reason for this SPAC craze is the growing trend within markets for unicorns (private companies with a valuation of over $1 billion) to stay private for longer. Access to capital throughout the increasingly developed private equity market – from venture capital through to more mature private equity investors – has increased substantially over recent years. Thus, the need to tap into public markets, which carries the burden of increased disclosures, regulatory requirements and sometimes high costs which can put off company founders or management teams who want to maintain control, has fallen away. Now with SPACs offering a route to public markets without the need for a cumbersome IPO, it’s not surprising this is becoming such a hot area of the market.

Despite the obvious benefits of SPACs, there are several drawbacks. SPAC managers are highly incentivised to find a target investment within a specified time frame which does not always mean end investors’ interests are aligned. If a suitable investment is found, managers will often benefit from large fees by way of compensation. If the timeframe expires without an investment being made, investor capital is returned. This could encourage managers to find a target investment regardless of its appropriateness.

Interestingly, most SPAC listings have been in the United States which poses a major challenge for European exchanges and investors. A US-listed SPAC merging with a European company will mean that the European company ends up with a US listing. Whether European bankers, financial exchanges and policymakers choose to react quickly and encourage some of this activity this side of the pond in order to protect the region’s most valuable unicorns, or whether they consider the structures too opaque and risky in their current guise and choose to react in some other way, it remains to be seen. Either way we have not heard the last of SPACs.

STAT OF THE WEEK: 55% – the proportion of the global population living in an urban area, a marked increase from 34% in 1960 (Our World in Data).

Data correct as at: 12/03/2021

Contact us

Have a question about investing with EQ? Please email enquiries@eqinvestors.co.uk or call 020 7488 7171, we’re always happy to hear from you.