We are now just a few weeks away from the 2020 US Election where voters will cast their ballots to decide whether Donald Trump or Joe Biden controls the White House. There are also two concurrent elections taking place that will determine who wins 35 seats in the Senate and all 435 seats in the House of Representatives which are due for re-election. Commentators are focused on just two of these battlegrounds – the White House and the Senate – as the Democrats are broadly expected to retain control of the House.

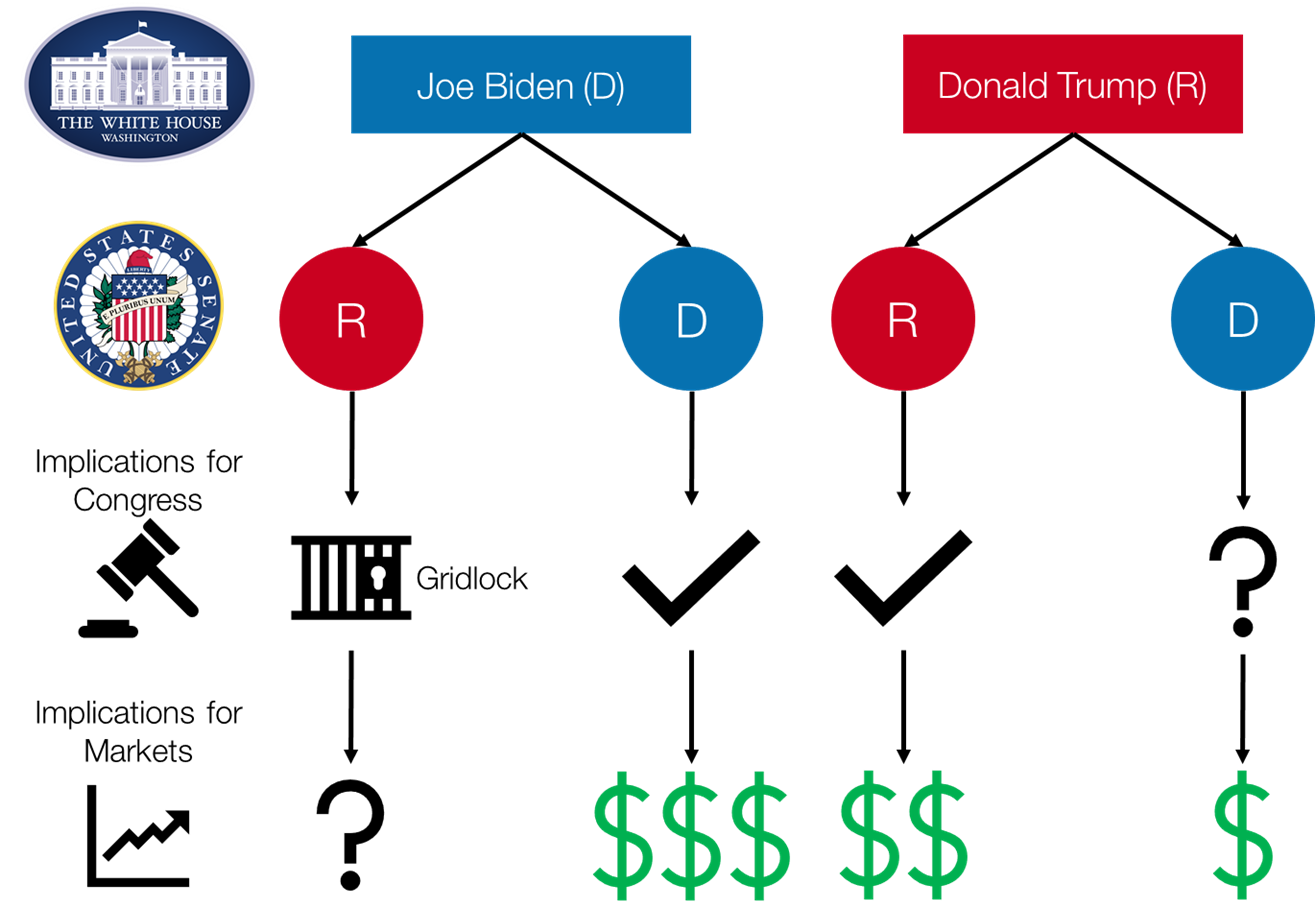

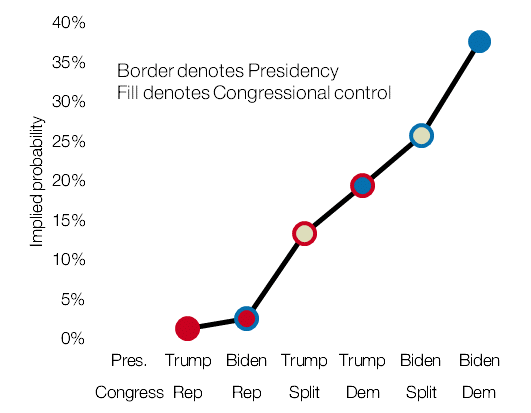

Figure 1: potential outcomes of the US election

Source: EQ Investors

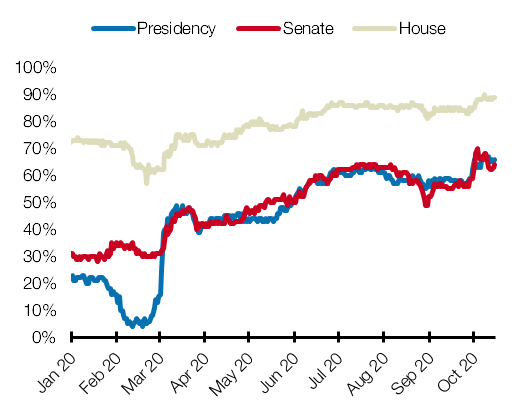

Figure 2: probability of a Democratic sweep

Source: PredictIt, EQ Investors

Source: PredictIt, EQ Investors

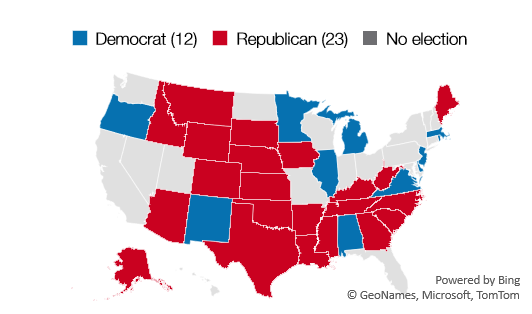

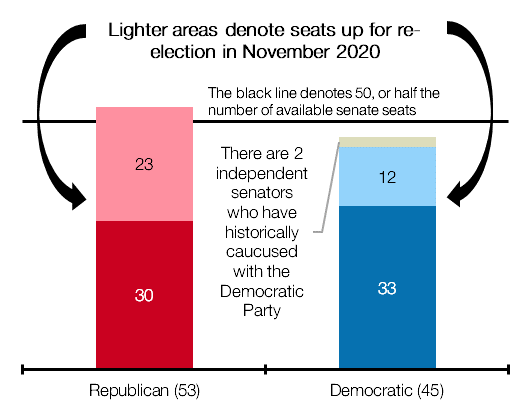

With two Independent senators who caucus with the Democrats, the Democratic Party will need to win three or four seats to gain a majority, depending on which party wins control of the White House. Technically speaking, in the event of a senate vote resulting in a tie, the Vice President of the United States (currently Mike Pence) may cast the deciding vote.

If the Republicans retain control of the White House, the Democrats will need to gain four seats in the Senate to control an overall 51-49 majority. If the Democrats win control of the White House, they will need just three seats with the new Vice President able to tie-break.

Figure 3: US states with a senate seat up for due for re-election

Source: EQ Investors

Figure 4: present composition of the US senate

Source: EQ Investors

Assuming the Democrats retain their 20 majority in the House (bookies currently imply a 90% probability they will), there are three potential election scenarios.

| Market implied probability | Moderate |

|---|---|

| Ability to enact policy | The most disruptive outcome for markets and the largest risk to financial stability. Republicans will retain veto on legislation and further stimulus which could risk derailing Biden’s agenda. This was the case during the latter stages of the Obama administration. Unlikely to see any new fiscal initiatives. |

| Economic implications | Continuation of low growth and low rates environment, recovery slow. Positive tailwinds for continuation of Growth vs Value outperformance. |

| Market implied probability | High |

|---|---|

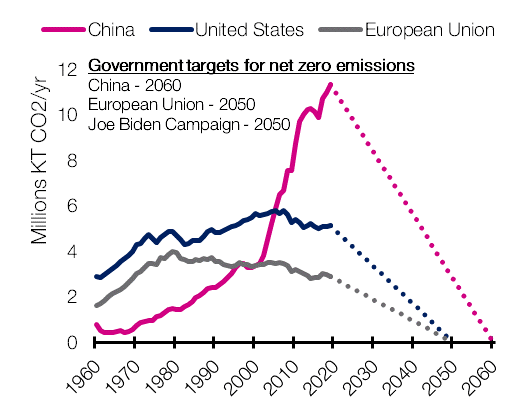

| Ability to enact policy | Democratic sweep would lead to increase in government spending, financed through increased government revenues (e.g. potential reversal of Trump’s tax cuts) and higher government borrowing. Without a landslide result in the Senate, Democrats likely unable to implement full agenda, instead will focus on pro-growth policies (Covid fiscal stimulus, infrastructure spending and green industrial policy) to secure place for 2022 mid-term elections. Small yet growing risk of regulation that may impact future competitiveness of big-tech |

| Economic implications | Growth vs Value outperformance less extreme, select cyclical industries to do well but key areas of Value will face headwinds (i.e. Energy). Winners across clean technology value chain (renewables, EVs etc.). Yield curve steepening and rising rates in anticipation of new debt issuance. Short duration to offer protection here. |

| Market implied probability | Moderate (Dem. Congress) Low (split congress) |

|---|---|

| Ability to enact policy | Current polling data would suggest this outcome is unlikely. Nevertheless, assuming no change in the House, Congress would still be split with the Republicans controlling the Senate and Democrats controlling the House. Likely to see Trump administration and Democratic House attempt to find common ground on areas such as infrastructure and stimulus (and even a hard stance on China), but unlikely to see any transformative, pro-growth legislation. |

| Economic implications | No significant pro-growth policies could lead to period of low growth and continued low rates. Positive tailwinds for continuation of Growth vs Value outperformance. |

Figure 5: Joe Biden’s net-zero target will be yet another tailwind for already buoyant environmental equities

Source: World Bank, European Commission, EQ Investors

Figure 6: current market implied probabilities indicate likelihood of Democratic control

Source: PredictIt, EQ Investors

Be prepared

While both public polling and election probabilities point to a Democratic win, we take a cautious stance when interpreting this sort of data. In particular, we avoid taking significant sector or regional bets when there are so many variables to consider. We think the most prudent course of action is to maintain an element of caution until there is greater certainty. We maintain our focus on high quality companies and within defensive sectors.