According to Ed Miliband, the Secretary of State for Energy Security and Net Zero, the Labour Party is “offering the country the most ambitious climate and energy plan in British history”.[1] Under Labour’s Green Prosperity Plan, two new governmental bodies have been created, the National Wealth Fund and Great British Energy.

The National Wealth Fund (NWF) works to align the UK Infrastructure Bank and the British Business Bank toward investing in new industries of the future. As part of this alignment, £7.3 billion will be allocated through the UK Infrastructure Bank so that investments can start being made immediately. The NWF will look to invest £1.8bn into ports, £1.5bn into gigafactories, £2.5bn into clean steel, £1bn into carbon capture and £500m into green hydrogen.[2]

Likewise, Labour is targeting to attract £3 of private investment for every £1 of public funding via the NWF, which if successful would boost total investment to £29bn. Lisa Quest, one of the UK’s Managing Partners at Oliver Wyman, stated that “the NWF will help the UK keep pace internationally with a growing list of countries using innovative public funding tools to attract significant private capital required to accelerate decarbonisation technologies and grow their economies”.[3]

Similarly, Great British Energy is the planned public-owned company which will seek to push the UK toward energy independence, strengthen its clean energy capabilities and allegedly create 650,000 jobs across the country by 2030. According to the Labour Party, Great British Energy will reportedly generate 8 gigawatts of energy by 2030 and will aim to power 20 million homes.[4] It has been announced that GBE will be backed by £8.3bn of capitalisation issued by Parliament and will also cover running costs through a 78% windfall tax on oil and gas giants.

In the run up to the election, Labour stated that it would spend £28 billion a year to fund their net-zero policies once in power and that they would generate £10.8 billion over 5 years from their oil and gas windfall taxes. However, both figures were reduced before the election took place as voters questioned the feasibility of achieving these figures.

Questions around how the government plans to finance these projects remain largely unanswered; however, the government has announced that they are planning to issue £10 billion of green gilts in 2024-2025 (amounting to 0.37% of 2023 GDP) and they have already issued £3.5 billion in the first two months of the financial year.[5]

To meet its lofty and ambitious climate objectives of becoming energy independent and powered by 100% clean energy by 2030, the government may look to increase its green gilt issuance. Historically, green gilts have been consistently oversubscribed (as an example, the most recent green gilt issuance was covered 3.5 times over), reflecting strong investor appetite and indicating promising potential to meet future debt financing needs.

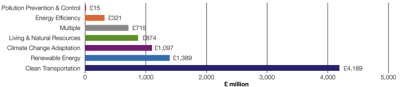

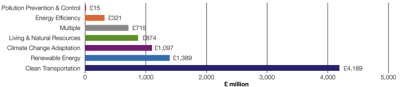

By way of comparison, green gilt issuance in 2022-2023 raised £10 billion; of which almost half was allocated to clean transportation. This is contrasted by Labour, who have outlined their preference to allocate toward renewable energy instead.

2023 Allocation split by Category, Source: UK Green Financing Allocation Report 2023

Nevertheless, sentiment around Labour’s push for a more sustainable economy has been met with cautious optimism from investors. The previous Conservative administration often flip-flopped on climate proposals, leaving potential investors nervous to put money into sustainable investment solutions. Labour, however, has delivered more steadfast rhetoric which should leave potential financiers more at-ease with committing capital for the longer term.