IPCC report findings

Updated every 7 years, the Intergovernmental Panel on Climate Change report aims to summarise all of the scientific research findings (over 14,000 papers) on climate change. Its purpose is to serve as the universal body of evidence upon which decarbonisation strategies, targets and policies can be built.

New evidence gathered has led to the overarching conclusion that the human contribution to climate change is unequivocal. Since the last report, the level of confidence with which warming, sea level rises, and ice cap melting can be pinned to human greenhouse gas emission has increased. These adverse trends will accelerate as emissions further increase (or even if they stay constant), because positive knock-on effects come into effect. For example, much of previous emissions have been absorbed by the oceans, but this “sink” reduces in potency as the oceans warm.

Importantly, the report shares evidence on the effect climate change has already had: on average, the Earth has warmed by 1.09°C since preindustrial levels already, and sea level rise is accelerating due to melting arctic ice caps and warming waters. One key new finding of the report concerns extreme weather events, with the observed increased frequency and intensity now confidently being linked to human induced climate change. In the light of Greece’s and Turkey’s current devastating forest fires, and flooding in much of central Europe – this finding hits closer to home than ever.

It is widely agreed that 1.5 degrees of global warming since pre-industrial levels is the safest, yet still realistic target for us to avoid the most devastating effects of warming. The IPCC report includes updated climate scenarios, which are climate models of the outcomes of different levels of “climate action” taken globally. They help demonstrate the level and speed of decarbonisation that is necessary to limit warming to 1.5 degrees. Looking at the results of the climate modelling, it is evident that this target is becoming harder to reach because of our lack of action so far. The only scenario that limits us to 1.5 degrees assumes drastic global emissions reduction globally, meeting net-zero around 2050 and continuing with significant carbon capture thereafter.

As mentioned in our previous blog, according to Climate Action Tracker, our current decarbonisation policies will produce over 2.9°C warming by the end of the century.

To prevent an irreversible change to the planet, the world needs to reduce the almost 50 billion tonnes of greenhouse gas emissions each year (as measured in carbon dioxide equivalents, CO2e) – with an end goal of reaching net-zero. The IPCC report is a strongly worded call from the scientific community for policy makers to step up their ambitions in the upcoming climate talks at COP26, and match “net zero” pledges with action. As the effects of climate change relate to cumulative emissions – we need to make most advances in this decade.

Who are the largest emitters, where is the carbon risk?

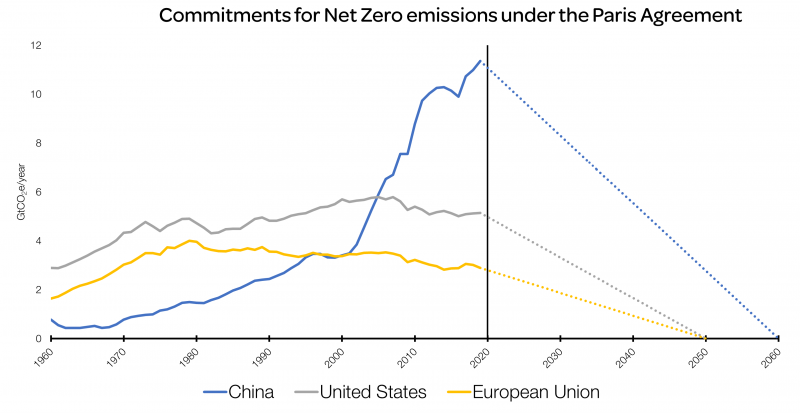

China’s economic ascent over the last three decades has been reflected by a meteoric rise in its emissions. But despite China becoming the largest polluter on the planet, its per capita emissions are still below the US and only marginally higher than the European Union. The direction of travel is unnerving. Nevertheless, the Chinese Communist Party has committed to achieving net zero emissions by 2060, though that is a full 10 years after the European Union and the United States who are aligning themselves with the 2015 Paris Agreement.

Figure 1. While the United States and the European Union have seen falling GHG emissions, China’s economic rise has seen it become the world’s largest polluter

Source: World Bank, European Commission, EQ Investors

Source: World Bank, European Commission, EQ Investors

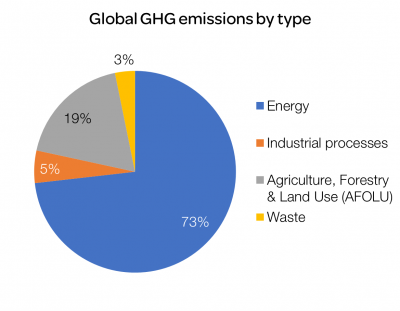

Figure 1 illustrates the scale of current emissions, and the scale of decarbonisation needed by some of leading world economies in order to meet net-zero goals. Figure 2 shows that the greatest concentration of carbon emissions is from “Energy” use – a broad category that spans generation and consumption and includes, for example, home energy use and transportation. Decarbonising our energy use will impact across sectors and industries:

Figure 2. Energy generation and consumption are by far the largest contributors to greenhouse gas emissions emissions globally

Source: Our World in Data (2016), EQ Investors

Source: Our World in Data (2016), EQ Investors

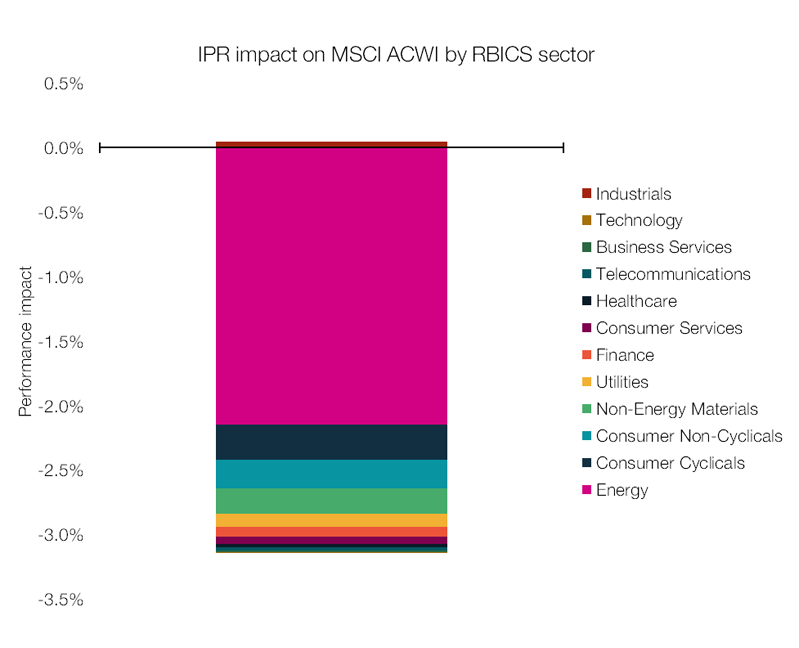

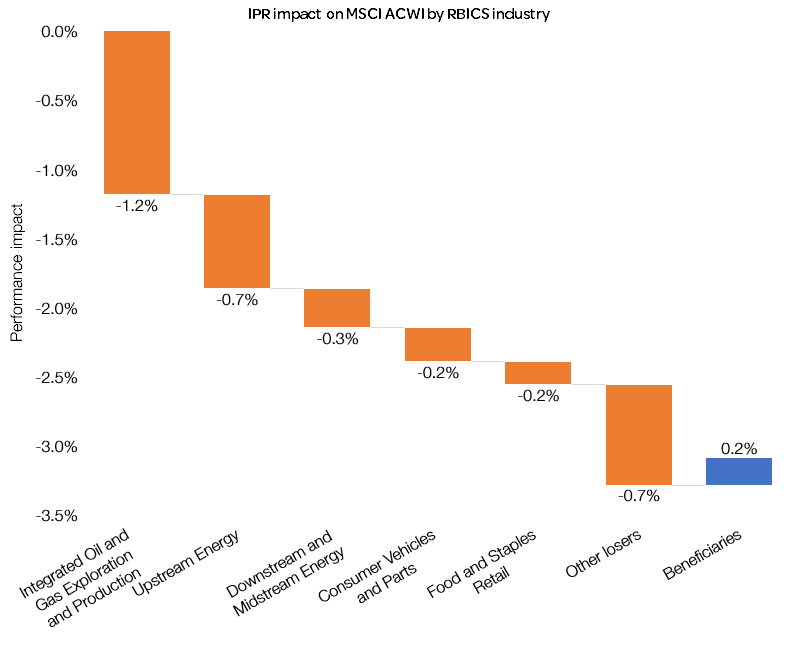

In light of the IPCC report findings, we believe there is an increased likelihood of stronger policy responses across economies setting net-zero targets in the upcoming COP26 meeting. There has been great progress made in modelling the implications of a knee-jerk reaction from policymakers within the Inevitable Policy Response (IPR). The IPR represents a scenario in which governments are forced to act more decisively than they have done to date to meet net zero targets by 2050. Naturally, the most carbon intensive equity sectors are those most at risk of disruption in this event (Figure 3). There will undoubtedly be opportunities that emerge from a sudden shift to an IPR scenario, but investors also need to understand, and act on the risk posed to equities in the relevant industries (Figure 4).

Figure 3. The impact on the value of global equities is modest in percentage terms, but equates to over $1.5 trillion in market capitalisation

Source: UN PRI, Vivid Economics, EQ Investors

Source: UN PRI, Vivid Economics, EQ Investors

Figure 4. Among industries most affected are within the energy sector, OEM autos, and those Food and Staples Retail companies with agricultural operations

Source: UN PRI, Vivid Economics, EQ Investors

Source: UN PRI, Vivid Economics, EQ Investors

The role of investors

Such climate action implication modelling on financial markets, with examples shown in Figures 3 and 4, will influence investment decision making in the fund managers we select.

The IPCC report findings, and the potential increased government response to the outlined urgency, solidifies the importance for investors to integrate low-carbon transition and physical climate risks into their investment decision-making. In addition, investors should be focusing on potential investment opportunities that climate solution companies, or those leading the low carbon transition in their sectors, may open up.

Investors have a key role to play in contributing to the rapid low carbon transition we need. Using their engagement and voting practices with underlying investee companies, we can help push for more ambitious targets and speedy action by polluting corporates. To those companies that are irresponsive to engagement and are lagging behind the expected decarbonisation trend, investors should divest and divert this capital to transition leaders.

Co-authored by Tertius Bonnin, Assistant Portfolio Manager, EQ Future Leaders portfolios.