Four years ago, we launched a sustainable portfolio strategy with a difference. Our idea was simple – to construct a low-cost passive solution that could deliver robust returns whilst contributing to the UN Sustainable Development Goals (SDGs).

The SDGs provide a framework to outline the most pressing social and environmental challenges we face. The EQ Future Leaders Portfolios align with them by supporting companies that are working towards addressing those challenges.

Below we dive into the sustainability process, looking at how and why the EQ Future Leaders portfolios go beyond just negative screening, and are more ambitious than our peer group when it comes to sustainability.

Setting ambitious goals

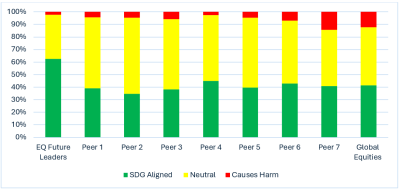

The EQ Future Leaders Portfolios aim to have higher exposure to the SDGs than traditional investments.

To see how they compare to other solutions, we have analysed seven anonymised, passive sustainable peers within the managed portfolio service (MPS) market with a range of results.

As you can see, the EQ Future Leaders Portfolios achieve a 60% alignment to the UN Goals, over 20% more than the sustainable peer-group average. This is achieved in part through the intentional inclusion of sustainable thematic satellite themes, including climate solutions, clean water, digital security, green bonds, and healthcare. The SDG alignment has increased by 10% since the launch of the portfolios four years ago, reflecting our ambition to improve sustainability credentials over time.

In comparison, our peers only display between 35-45% exposure to the UN SDGs.

Based on our assessments of their investment processes, the existing exposure to UN SDG solutions companies is a coincidental outcome, mirroring similar levels of exposure to the unscreened market.

Addressing climate risk and contribution

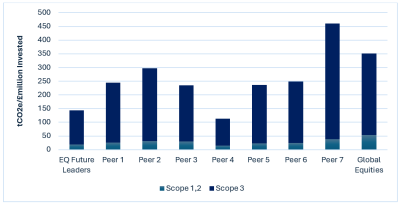

Measuring and monitoring portfolio carbon emissions is essential for assessing climate-related risks. To show the EQ Future Leaders’ intention to manage these risks and produce lower associated emissions than the benchmark, we display the comparative carbon footprints below.

As our assessment shows, most of the sustainable passive MPS have similar or higher carbon emission intensities. All currently present lower emissions compared to the global benchmark.

We also need to assess how this pattern may change over time. The core of the EQ Future Leaders Portfolio is aligned to the 2015 Paris Climate Agreement in its intention and process, which means we can expect the low carbon leadership to continue over time. This is because the index methodology mandates a 7% reduction year-on-year in addition to a lower carbon footprint today. All but one of our peers lack this explicit integration of Paris-aligned methodologies to their investment product selection.

Portfolio X-Ray

A full look at the underlying holdings within the funds held in the sustainable passive MPS peers reveals an elevated level of misalignment of screening methodologies. This means, while some funds apply a screen or sustainability threshold, another may not. This results in negative exposures that would not be passable by the EQ Future Leaders strategy.

- 7/7 of the peers have exposure to businesses involved in oil and gas extraction (e.g., BP or Total), while 4/7 have exposure to businesses with thermal coal reserves (e.g. RWE, Tata Power)

- 6/7 of the peers have exposure to gambling (e.g. 888 Holdings or Caesars Entertainment)

- 5/7 of the peers have exposure to ESG (Environmental, Social, and Governance) Laggards in their respective industries such as Meta and Amazon.

In summary

The EQ Future Leaders Portfolios far exceed the sustainability standards of passive peers. We achieve this through engagement with managers to elevate their sustainability ambition, exploration of new fund opportunities, and an in-depth due diligence on the underlying holdings to ensure our screening processes deliver sustainable outcomes.

Understand your investments

Should you wish to compare the EQ Future Leaders portfolios to your current proposition, we’d be happy to conduct portfolios x-rays of existing portfolios.

Please email us at: dfm-enquiries@eqinvestors.co.uk