Humanity’s greatest challenge

The climate crisis is one of the biggest challenges of our time. We know that greenhouse gases, of which carbon emissions are the most prominent, are the biggest drivers of climate change and the sustained rise in global temperatures.

A proportion of the carbon emissions released into the atmosphere every year come from companies, across all economic sectors. It is important to remember that every company has some degree of climate change contribution, however some are far more polluting than others.

Why we developed the EQ carbon calculator

When investing in EQ’s range of sustainable portfolios, or any investment portfolio, you become a part shareholder of the companies held within it. That means, the positive and negative impacts of those businesses are partly associated with your personal investments.

According to a recent ONS survey, 75% of adults in Britain are worried about climate change, and therefore may want to know how their investments stack up. The EQ carbon calculator is aiming to provide clients and prospects with transparency over the associated carbon emissions with the investments we manage.

At EQ we integrate climate risk in all investment decisions and pay close attention to keeping associated carbon emissions lower than market indices.

What the carbon calculator displays

The carbon calculator is split into three sections:

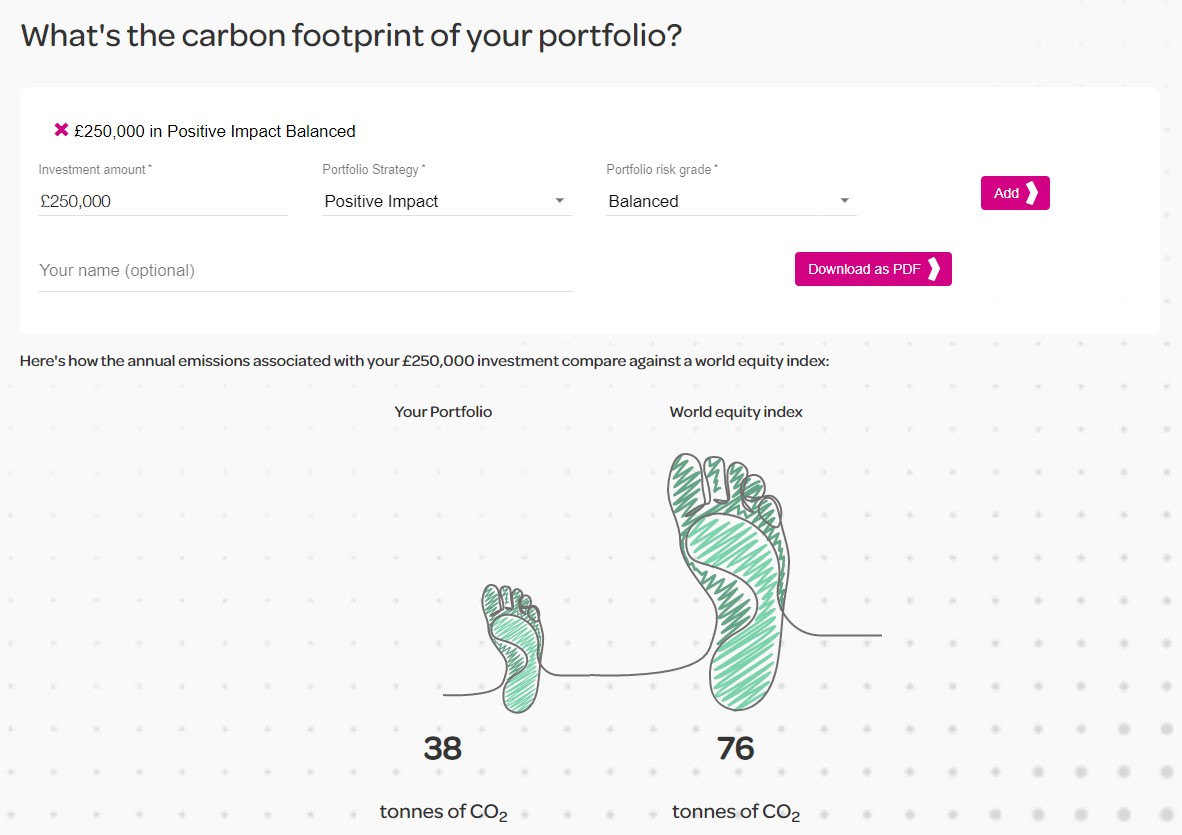

The first shows the associated carbon emissions with a specified amount invested in a (or a selection of) EQ portfolio(s). This covers the equity portion of the portfolio and compares it against an equity index of global companies. This should give a good indication of the comparative carbon footprint of investing in EQ’s sustainable portfolios vs investing without a sustainable objective.

The second section focuses on the difference in the tonnes of carbon associated with the two investments and converts it into well-known activities contributing to global carbon emissions. Each equivalent activity represents the full difference.

The third section shows you the carbon data underlying the graphics, divided into the direct and indirect emissions of the companies held in the portfolios and index.

It should be noted that this difference in associated carbon emissions does not indicate that the selected EQ portfolio is effectively saving the emissions from being emitted in the real world. The impact of investing with a low-carbon objective is instead a systemic one and can have significant collective impact.

In addition, a lower associated carbon footprint can be a helpful proxy for many things:

- The companies held in the portfolio have a lower climate change contribution

- The investments are less exposed to climate transition risks, which can come from anticipated carbon taxes, more stringent industrial regulations, and reputational damage

- The investments are better placed to be future fit in the face of rapid climate action, making climate leadership a competitive advantage

To maximise individual impact on global climate change mitigation, direct individual actions (changing consumption patterns, lifestyles, activism and/or voting) could be considered alongside investing sustainably.

How to use the carbon calculator

Select the amount invested, portfolio strategy and risk grade to generate the carbon footprint. The carbon calculator can be personalised and dual-branded in PDF format for your clients.

You will be able to include this in your reports to your clients, illustrating performance against this climate change lens of sustainability.

Find out more, visit: https://eqinvestors.co.uk/advisers/carbon-calculator/