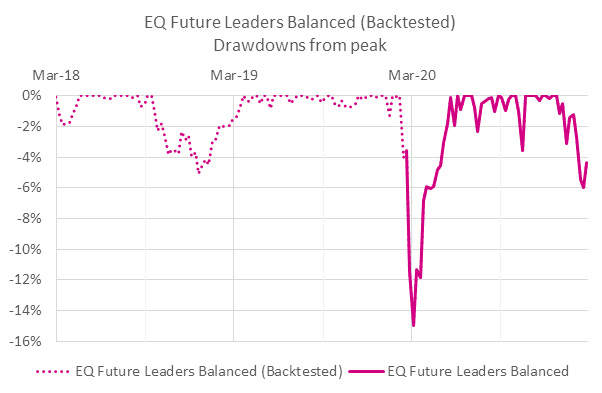

The chart above shows historic drawdowns of the Future Leaders Balanced portfolio since its launch in February 2020 to which we have added a couple of years of backtested data. Markets don’t go up and down in straight lines, so there will always be some drawdown, but typically these have been limited to around 2-4%. There are some occasions when losses exceed this level but it’s usually during significant global macro challenge. In 2018/19 it was the US-China trade tariffs and rising US interest rates, and in 2020 it was the coronavirus. In 2021, the drawdown is being caused by rising US bond yields, themselves driven by rising inflation expectations.

This is simply part of the “reopening trade”. With vaccine rollouts picking up pace, albeit at different speeds around the world, talk has turned to lifting social distancing restrictions and getting life back to normal (whatever that looks like now!). Economic activity is rising, in some cases from zero. Compared to a standstill, any activity is inflationary. So, the key question is whether these increases in inflation are more structural or if it will just be a short-term blip as economies get back up to speed.

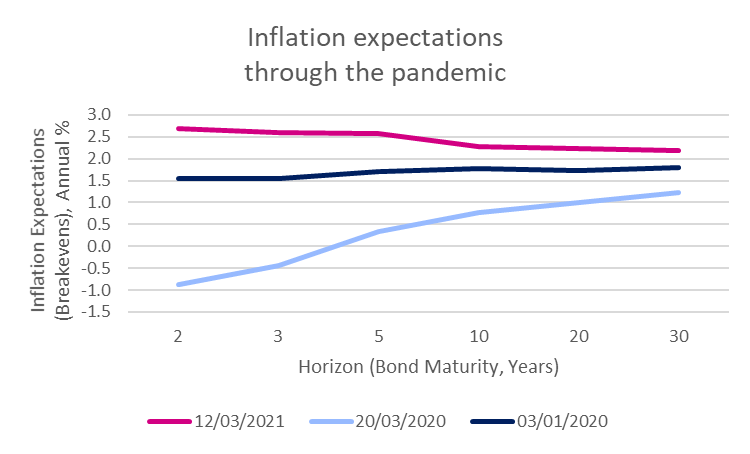

We can tell what the market currently thinks about this by looking at what level of inflation is currently expected in the inflation linked bond market, in the chart below. The dark blue line shows expectations in January 2020 before the pandemic took hold, with inflation expected to be around 1.5-1.8% over all time horizons. In the depths of the coronavirus crisis less than three months later (in the light blue line), the market was seeing deflation in the short term and barely a hint of inflation over longer time frames.

Currently, the expectations curve is inverted. The market expects inflation in the short term to be higher than in the long term. In other words, a blip. Keen eyed readers will note the curve today is still higher than it was pre-pandemic. Given greater coordination between central bank monetary policy and government spending, we think this is fair. But it’s too soon to say whether expectations will (or should) rise further or whether we are at around peak levels already. There are compelling arguments on both sides of the inflation/ disinflation divide and currently we have sympathy with both of them.

As such, we recently decreased portfolio exposure to defensive sectors such as healthcare and added to more pro-cyclical parts of the market. As you would expect, we did not invest in oil majors, not only due to sustainability reasons but also because the long-term back drop for this sector remain quite uncertain. So, we opted to gain cyclicality by increasing exposure to economic sensitive sectors such as industrials and increased our exposure to cyclical markets like the UK and Asia. Finally, we have reduced the sensitivity to interest rates within the fixed income part of the portfolios.

Environmental, Social & Governance (ESG) leaders and higher growth companies trade at valuation premiums but as bond yields and inflation expectations have risen, these premiums have been eroded. Or more simplistically, investors have been rotating out of more expensive long-term structural growth such as clean energy and healthcare in search of shorter term, cheaper cyclical growth like energy and financials. They have also favoured companies with lower considerations for environmental and social matters.

There is absolutely nothing that changes our long-term view of the structural sustainable themes and our preference for ESG leaders. So, the question is whether lower prices of these themes and companies today are an attractive buying opportunity or whether there is more volatility ahead for interest rates if inflation expectations continue to rise. We are comfortable with portfolios for now and believe they are well positioned, but we will be adjusting portfolios accordingly in case evidence points more firmly to a structurally higher inflation environment in the future.