At the beginning of July, the film director & campaigner Richard Curtis joined Mark Carney, the former Governor of the Bank of England to launch the ‘Make My Money Matter’ campaign. The idea behind the campaign is simple – we can use the £3 trillion invested in UK pensions to create a better environment and society.

Make My Money Matter is calling on all UK pension funds to follow the exam ple of Nest, the UK’s largest pension fund to commit to Net Zero emissions. For the first-time, a leading UK Pension Fund will ensure that its entire portfolio – managing the savings of over 9 million people – will be invested in line with the Paris Agreement, helping create a more sustainable and resilient world for us all.

ple of Nest, the UK’s largest pension fund to commit to Net Zero emissions. For the first-time, a leading UK Pension Fund will ensure that its entire portfolio – managing the savings of over 9 million people – will be invested in line with the Paris Agreement, helping create a more sustainable and resilient world for us all.

As a launch partner of the Make My Money Matter campaign and a signatory of the B Corp Climate Collective NetZero 2030 initiative, EQ Investors has committed to net zero emissions by 2030. An increasing number of our clients are demanding to invest in line with their values, some of which are climate change driven. We want to ensure we provide you with the best disclosure.

Why are carbon emissions important?

Climate change isn’t something that’s happening in 10 or 20 years. It’s happening now. In 2010, global average temperature was 0.88˚C (1.6˚F) above pre-industrial levels. Temperature increase in 2019 is shaping up to be about 1.1˚C (2˚F) above pre-industrial levels.

Human induced carbon emissions are the leading cause of global climate change. These include the burning of fossil fuels (such as coal) for heat and electricity, agriculture (such as from livestock), land use changes and some chemical and industrial processes (like cement production). Natural feedback loops (releases from oceans, ice caps and forests) are making the problem worse. Around the world, its effects (like droughts, flooding, and wildfires) are already devastating communities, causing migrations, scarring landscapes and causing billions of dollars’ worth of economic damage.

While nations around the world have set themselves targets to reduce national carbon emissions over time, this isn’t enough. The private sector must also help; through both public awareness and regulation there is an increasing realisation of responsibility in this challenge.

Why are we reporting on emissions for our investment portfolios?

As concerns surrounding climate change continue to intensify, investors increasingly need to understand how this could impact their investment portfolios. The implications of climate change will affect the investment opportunities and risks for all investors, regardless of whether they subscribe to environmental, social, and governance (ESG) principles.

Carbon emissions, due to their link to climate change, are the best proxy we have to understand how much a company or investment is potentially exposed to the ‘transition risks’ arising from economic and policy measures aimed at mitigating climate change.

The entire UK has committed to a target of net-zero emissions by 2050. This will mean that companies with high carbon emissions will need to de-carbonise across sectors. Such effort requires innovation, and capital expenditure. The inevitable policy response may also ‘push’ companies to do this by increased carbon taxes.

Greater incentives for ‘green’ investments, lower support for higher carbon-emitters that are making no effort to de-carbonise (e.g. the EU Green Deal, embedded in the EU COVID Recovery Budget 2020). This can translate to diverging cost of capital between carbon-intense and “green” businesses.

Further to this, new Financial Markets regulation is in the process of differentiating whether a fund’s approach is aligned with ‘green economic activities’ (mostly low-carbon activities) or not. The aim is to shift more capital to these types of investments. Companies aligning positively with these desirable activities will thus benefit from long-term investment tailwinds.

Finally, alongside the annual carbon footprint, carbon reserves may become ‘stranded assets’ as their development becomes uneconomical and demand reduces.

Measuring carbon emissions

Measuring the carbon footprint of a portfolio means you can compare it to global benchmarks, identify priority areas and actions for reducing emissions and track progress in making those reductions.

We have recently added two carbon measures to our Future Leaders and Positive Impact factsheets:

Carbon footprint of the portfolio

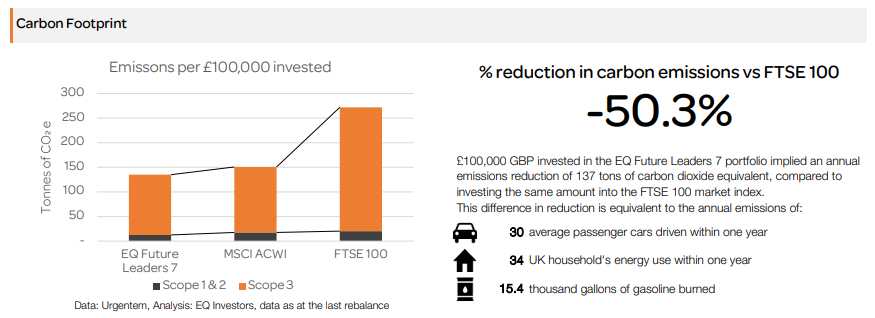

The carbon footprint of a portfolio is a measure of a portfolio’s exposure to carbon-intensive companies. As portfolios will need to continuously decarbonise to tackle global climate change, low emissions portfolios are better prepared for climate change ‘transition risks’, including from regulation.

To calculate the carbon footprint of the portfolio we use an industry standard methodology. This allows us the ability to associate the tonnes of CO2 equivalent emitted per £100,000 invested – to get the carbon intensity of the investment, as shown below.

Climate change scenario chart

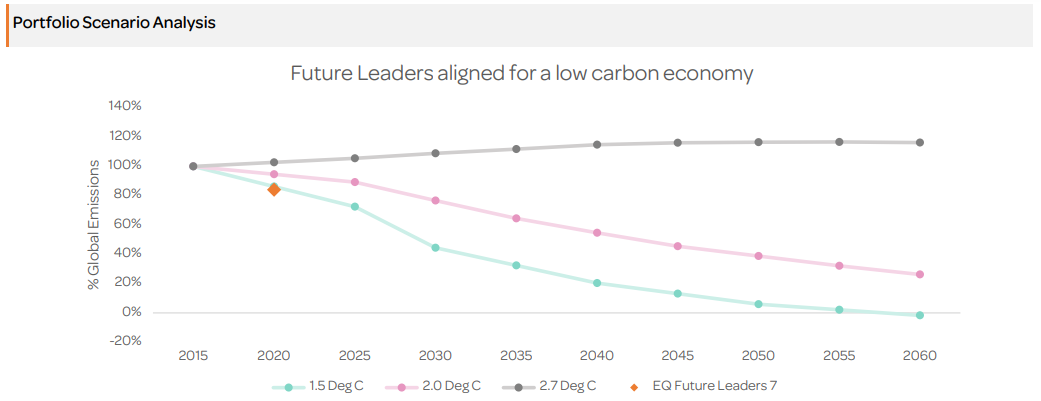

Climate change’s current path is still uncertain and depends on how fast the global economy responds to the challenge to cut global carbon emissions – the main driver of global climate change.

It is therefore relevant to understand whether the companies within a portfolio are aligned to a desirable emission reduction pathway and track whether the companies reduce their emissions at the necessary rate.

It follows, that if we want to limit warming to a lower degree, we need to decarbonise our economy (and companies) faster.

The chart below shows three different scenarios for carbon emissions, corresponding to a 1.5°C, 2.0°C and 2.7°C rise in global temperatures by 2060. Climate scientists and global leaders have agreed that limiting temperature rise to 1.5°C is the most desirable scenario.

Going forward, we believe all investors will consider the potential risk and return impacts of the low-carbon transition on their portfolios.

Investing with EQ

Have a question about investing with EQ? Please email enquiries@eqinvestors.co.uk, we’re always happy to hear from you.