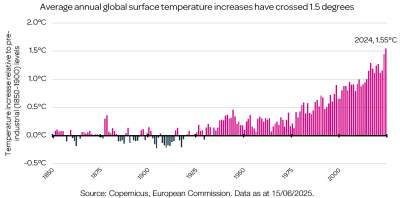

Climate change is no longer a future threat – it’s already causing severe social and financial impacts. In 2024, global temperatures reached a record high, 1.55°C above preindustrial levels, surpassing the Paris Agreement’s 1.5°C target.

Although that target is based on a 20-year average, the recent rapid temperature rise signals an urgent need to cut emissions. As temperatures climb, extreme weather events become more frequent and intense, driving up the cost of natural disasters to $368 billion last year.

While climate finance has traditionally focused on mitigation (reducing emissions), there is growing emphasis on adaptation – preparing for and managing the impacts of climate change.

Key areas with strong adaptation potential include insurance, water management, and smart grids. Beyond these, building more resilient infrastructure and developing drought-resistant crops are essential for a broader adaptation strategy.

Notably, only 40% of last year’s economic losses were covered by insurance, highlighting the crucial role the insurance industry must play in supporting climate adaptation efforts.

The insurance industry is uniquely positioned not only to assess risks but also to drive resilience. Leveraging their expertise in risk management, insurers can identify climate-related physical risks – like floods, wildfires, storms, and heatwaves – and incorporate these into pricing and product designs, encouraging policyholders to adopt more climate-resilient behaviours.

Water scarcity presents another critical challenge as global temperatures rise. While companies can address water stress through improved efficiency, waste reduction, and treatment solutions, droughts and shortages are expected to affect more regions.

Effective water system management is essential for climate adaptation, and emerging technologies like AI offer promising tools to enhance efficiency in this area.

Climate change – through extreme weather and rising temperatures – poses serious risks to power grids, causing outages, infrastructure damage, and efficiency losses. Coupled with rising electricity demand, this underscores the critical role of smart grid solutions that use digital technologies, advanced communication, and data analytics to optimise electricity generation, transmission, distribution, and consumption.

Our analysis shows that many investors overlook the physical climate risks companies face and their financial implications. In contrast, sustainable investors tend to better grasp both the short- and long-term risks and opportunities these industries meet as global warming progresses.