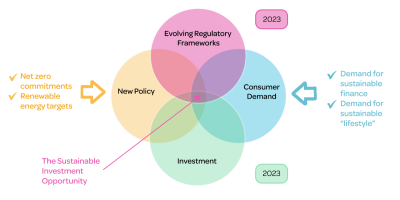

Against a backdrop of challenging market conditions and ongoing global events, there are several drivers which are supporting the sustainable investment opportunity. These tailwinds range from new policy responses, to evolving regulatory frameworks, and from changing consumer demand to government investment flows.

In the last few years, we have seen great leaps in consumer interest in sustainability, which is now coupled with a regulatory push to accommodate these interests into investment recommendations by the FCA (FCA SDR and Consumer Duty changes). The last few years have also presented a flurry of high-level sustainability policy commitments by governments, such as “net zero” plans.

We see 2023 as a pivotal year, as even more powerful tailwinds act in unison.

Firstly, we expect the impact of a number of new concrete industry legislations to come into force in 2023, which will make non-financial performance of companies more material. One such example is a new minimum proposed energy efficiency rating (EPC) for rental properties in the UK starting from 2025. This will result in significant costs to upgrade substandard insulation, boilers, windows and more. However, it will benefit those companies providing these products.

Another is the EU’s carbon border adjustment mechanism, putting a price on carbon for key imported raw materials. This will hurt companies “offshoring” emissions and provide a boost to the competitive advantage of responsible companies already procuring cleaner materials.

On the social side, the German Supply Chain Actis intended to improve international human rights, by defining requirements for responsible supply chain management. This has significant implications for companies operating in Germany, with fines of up to €8 million for businesses that don’t comply.

Secondly, we expect more government spending on sustainable sectors in 2023. Let’s take the example of decarbonisation. Through its Inflation Reduction Act, the US will unlock over $370bn in tax cuts and grants for US domestic green technology businesses like renewables, electric vehicles, and smart power grids.

This has kick-started a form of “green competition” between countries, with increased economic incentives for green businesses. For example, the EU has just released details on its Green Deal Industrial Plan for the Net-Zero Age.

While much of the necessary solutions to fight climate change are already economical, it will help accelerate their take-up and help more innovations to materialise. The companies we own in our sustainable portfolios will benefit from these tailwinds.