Artificial Intelligence (AI) has been the centre of attention for financial markets over the past two years and has powered the performance of seven mega cap technology companies, often referred to as the Magnificent 7. Over $1 trillion has already been invested in AI since 2012 and another $3 trillion is expected to be invested by 2030 on hopes that productivity will be significantly boosted.

You will have seen those companies helping to build the AI infrastructure have performed well, including the likes of Nvidia and Taiwan Semiconductor Manufacturing Company (TSMC), but digital technologies take time to have scale effects on economies, especially in comparison to the investments made.

While some have been preoccupied by the AI theme, we have been following a huge opportunity in the healthcare sector. A new revolutionary type of weight loss drug, known as GLP-1s, has been shown to improve treatment outcomes for overweight and obese patients. This has the potential to provide enormous social & economic benefits in the short- and medium-term.

Many are hailing this new treatment as the biggest breakthrough in medicine since the discovery of antibiotics or the invention of vaccines, given its prospects to materially reshape our economies. We believe that financial markets are not yet fully appreciating the implications of a global roll-out of these drugs in the months and years to come.

What are the social challenges that obesity creates?

According to the World Health Organisation (WHO), in 2022, 2.5 billion people globally were overweight (which is defined as having a BMI over 25), of which 890 million people were living with obesity (a BMI over 30). Over the past 30 years, worldwide adult obesity has more than doubled and adolescent obesity has quadrupled. In the UK, nearly 28% of adults are living with obesity and in the US over 40% of adults are obese, a number expected to reach nearly 50% by 2030.

Perhaps the most obvious and best documented challenge from obesity is Type 2 diabetes, given its close association with high BMIs. Indeed, the risk of developing diabetes amongst obese people is 7x greater compared to those of healthy weight.

Health complications are not restricted to diabetes. Research links obesity to sleep apnea, psychological issues, and high blood pressure.

Carrying extra body fat may also lead to other serious health consequences such as cardiovascular disease (mainly heart disease and stroke), musculoskeletal disorders (such as osteoarthritis), and some cancers (endometrial, breast and colon). These conditions can lead to substantial disability or premature death. Indeed, an estimated 5 million people globally die due to obesity – 8% of total deaths.

A lesser-known fact is that the risk of health problems starts when someone is only slightly overweight, and that the likelihood of problems increases as someone gradually becomes more obese. Recent research has shown that long-lasting brain adaptations occur in individuals with obesity, reducing the rewarding effect of food intake which then may contribute to overeating.

What are the economic challenges that obesity creates?

Obesity cost the global economy an eyewatering $1.96 trillion in 2020 (or around 2.5% of global gross domestic product) and this cost is expected to double by 2035.

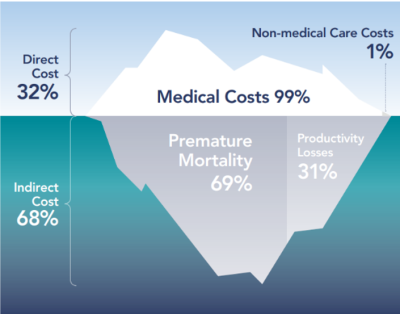

The World Obesity Foundation splits this figure into two, encompassing both direct and indirect costs. Direct costs are more obvious and include medical and social care expenses.

Indirect costs are less tangible, but easily dwarf the direct cost of obesity; these include premature death, as well as the costs associated with lost economic productivity.

Source: The World Obesity Foundation, 2022

Is obesity officially a disease?

According to the WHO, obesity is a chronic complex disease defined by excessive fat deposits that can impair health. Whilst it has been recognised as a disease by the WHO since 1948 (and by the American Medical Association since 2013) obesity has not been formally recognised as a disease by the United Kingdom.

So how can this epidemic be tackled?

At the heart of the solution is a hormone called “glucagon-like peptide 1” (hence GLP-1). This hormone is released by the intestine and instructs the body that it has eaten and that it should start several secondary processes such as the pancreas releasing insulin to reduce sugar levels.

In 2005, Eli Lilly, a US pharmaceutical company, launched a synthetic version of GLP-1 (branded as Byetta) as a diabetes treatment. It was administered in two daily injections to help people with managing their sugar levels.

In 2017, Novo Nordisk, the Danish based pharmaceutical company, launched Ozempic. While similar to Eli Lilly’s Byetta, the frequency of injections needed dropped from twice a day to once a week.

While GLP-1s were known to help with weight loss, the innovation brought forward by Novo Nordisk materially improved the drug’s weight-loss efficacy leading the US health regulator, the Food and Drug Administration (FDA), to approve a new generation of GLP-1s for chronic weight management.

Weekly injectable GLP-1s produced by Eli Lilly (Zepbound) and Novo Nordisk (Wegovy) can help obese patients lose 15-20% of their body weight by reducing their appetite. Indeed, one of the side effects of GLP-1s is that it slows down how quickly food is digested, helping the individual to stay full for longer.

Where are we now?

Since being approved in the US, other countries including Denmark, Japan, Germany and the UK have followed. The scale of growth in these drugs is remarkable. Recent data shows that 5% of medical prescriptions in the US are for GLP1, and that 3% of US adults, an estimated 8 million people, are using GLP1s specifically for weight loss purposes. Close to two-thirds of Americans (64%) say the drugs have been either “extremely effective” or “effective” at helping them lose weight.

Despite limited insurance and national health service coverage for non-diabetic people, overweight and obese people are keener to spend their own money on GLP-1s than any other drugs despite the high cost.

As a result, the demand is so high that many potential patients are facing shortages, pushing regulators to consider less efficient “me-too” products to be produced by pharmacists. To meet the demand, Novo Nordisk and Eli Lilly are quickly ramping up their manufacturing capabilities, while enjoying a significant increase in their earnings growth pushing their share prices up.

Patients taking GLP-1s, trials have also shown a 20% reduction in the risk of heart attacks, strokes and cardiovascular deaths in non-diabetic patients with obesity and proven cardiovascular disease. There are also very promising results around chronic kidney disease and osteoarthritis.

Where next?

Whilst GLP-1 injection prices are relatively high in the US (less so in the UK) it is widely accepted that prices will come down year-on-year as production scales up, healthcare insurers negotiate lower prices, and a more competitive landscape appears.

Indeed, as many as 16 new obesity drugs could launch by the end of the decade (including from companies such as AstraZeneca, Roche or Pfizer) with average expected weight loss of 25-30% while also improving patients’ tolerability of the drug. The potential launch of GLP-1 oral pills from 2026 by Eli Lilly would also help increase adoption.

New studies are also exploring whether GLP-1 could help tackle sleep apnea, Alzheimer’s and reduce addiction such as alcohol and tobacco.

Winners and losers

Whilst the long-term effects of weight loss drugs are still uncertain, several winners and losers could start emerging in the coming years.

With $200bn of sales for GLP-1 drugs expected annually by 2031 – two thirds of which is likely to come from weight loss prescriptions according to Morningstar, the pharmaceutical sector should appear as a clear winner boosting profits of the companies involved.

With wider insurance coverage and more affordability, weight loss drugs would generate material positive social benefits, especially as people would be able to treat their obesity before it leads to costly chronic health condition.

The other large winner could be the economy. According to Goldman Sachs, the impact of loss weight drug on US gross domestic product could be boosted by 0.4% in their middle scenario and up to 0.8% in a more optimistic scenario. Fewer sick days, less unemployment and higher labour participation rates would be factors supporting GDP growth.

But there are likely to be losers too. According to data analytics firm Grocery Doppio, patients taking GLP-1s have reduced their grocery spending by 11%, with a 52% reduction in snacks and confectionary, 28% reduction in soda and sugary beverages, and a 47% reduction in prepared baked food. More surprisingly, they also saw their alcohol spending reduced by 17%.

Another piece of research from Morgan Stanley confirms that GLP-1 drugs impact consumer behaviours, with 61% of those having started a treatment spending less on take-out delivery and 63% spending less on dining at restaurants.

A revolution with already tangible outcomes

We are excited about the prospects of future societal benefits from both GLP-1 and AI. In the specific case of weight loss drugs, the benefits on overweight and obese people can be life transforming with relatively immediate impact on the economy and the healthcare system.

Whilst those benefits are limited for the moment due to shortages, significant manufacturing capacity investments already in place will help with the roll-out over the coming quarters and years.

It’s important that investors assess what part of their portfolios would benefit from this exciting revolution but also check exposure to companies and sectors that are likely to be negatively affected by consumer behavioural changes.

If you are interested in learning more about the exposures within the EQ portfolios, please reach out to the team for more details.