The coronavirus pandemic and the subsequent global suppression of economic activity has resulted in record unemployment rates. It’s also pushing more and more companies in challenged sectors to take advantage of government-backed support.

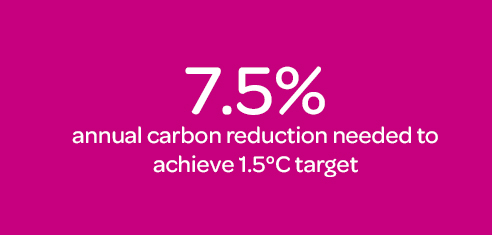

Global energy demand has plunged, meaning we will emit 4-8% less carbon into the atmosphere this year compared to last, the largest fall seen in history. However, climate models and emissions scenarios show we need even more; a 7.5% annual reduction, to keep climate warming to 1.5 degrees Celsius. This would help prevent the most devastating impacts of climate change.

Opportunity

This opens an interesting challenge: how can we rebuild our economies and nations better. If we don’t, our ability to protect ourselves from the social and economic shocks cause by the impact of climate change will mirror that of a global pandemic.

At a global level, there is an opportunity to align the announced economic packages around the world with a transition to a more sustainable society. Ideally these plans will bind unsustainable companies to a ‘just transition’, taking care to ensure employment opportunities remain a core focus while also implementing real changes to business models.

Economic recovery plans could provide incentives for those companies involved in sustainable economic activities.

Mostly positive signs

You may have read about the European Union’s proposed €750 billion funding to help the bloc recover from the coronavirus crisis. A quarter of spending has been earmarked for climate action and a ‘do no harm’ clause rules out environmentally damaging investments.

Integrating the EU’s Green New Deal into the package should see enhanced capital investment to green infrastructure, and reskilling programmes to benefit climate-positive businesses. The package still needs to be approved by the EU’s member states, but it would promote ‘green conditions’, which have been largely missing in most bailouts so far.

Perhaps unsurprisingly, the US government has opposed any calls to ‘build back better’. It is likely the financial bail outs will be extended to struggling businesses in the shale oil and gas sector, without any attached conditions.

What has already been happening?

Canada was the first country to make corporate bail-outs conditional. Canadian firms must file TCFD (Task Force on Climate-related Financial Disclosures) reports to receive bailout funds.

Particular attention has been put on one of the most hard-hit and emissions-intense group of companies – airlines. France has been a leader in re-thinking the problem systematically. One of the conditions imposed on Air France in exchange for a financial aid package, is to stop competing with rail on many in-land routes – ultimately cutting out many of the airline’s short haul flights.

Improving corporate governance

Another example of how sustainability is at the forefront of financial aid decisions is in respect to company governance. Countries including Denmark, France and Poland have just banned companies registered in offshore tax havens from claiming financial aid during the current crisis. This may serve as a much-needed push for more companies to pay appropriate contributions to the societies in which they operate.

A better future

These are just two examples of ‘building back better’. While the pandemic has hit whole economies, we believe that some companies can and will emerge stronger. From this point onwards, perhaps you should consider investing in companies that provide solutions to the sustainable future we should aspire to create.

Contact our impact investing team

Have a question about sustainable investing? Please email positive@eqinvestors.co.uk, we’re always happy to hear from you.