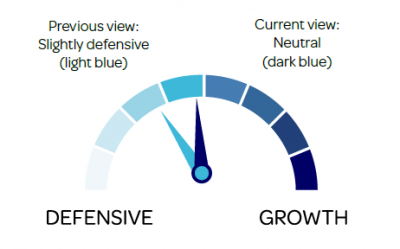

There has been no change to the biggest driver of risk which is still the coronavirus pandemic, along with government and central bank actions to combat the negative economic effects of social distancing measures. Despite this crisis being far from over, there have been new shots fired in the US-China battle. Given the surreptitious manner in which new security laws were introduced in Hong Kong, China now faces a much broader set of international condemnation. Adding the US election and Brexit into the equation, we anticipate a lot of noise during the second half of the year.

Download the Market View here.