For those who missed this gem, a Scotsman, Dale McLaughlan, has been jailed for jet skiing across the Irish Sea to spend some time with his girlfriend. McLaughlan, 28, has been sentenced to four weeks in prison for the 25-mile journey to the Isle of Man as his trip was deemed to break coronavirus lockdown rules. “The craziest thing is he can’t even swim,” said a relative, adding that he’s a “nice lad but thick as a brick”.

Markets have faced choppy waters of their own since the start of the new year. Investors have vied with fresh Covid-19 restrictions and the potential for a slower than hoped vaccine roll out.

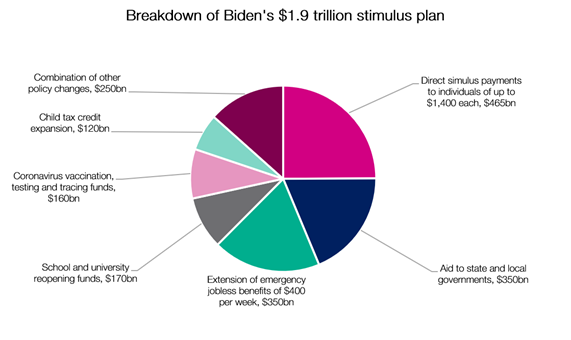

However, there has been some room for optimism. Many commentators are pointing to fresh pledges from the US president-elect which set out an additional $1.9 trillion in stimulus in addition to $900 billion in emergency aid agreed by Congress last month. It is expected that the incoming Biden administration will set out a further longer-term spending plan once in the White House. Among the commitments made by the president-elect is a $160 billion fund boost to coronavirus vaccination and testing and tracing capabilities. This forms a cornerstone of Biden’s first 100 day plan in which he has promised to reach 100 million vaccine doses administered.

| Figure 1: Biden’s stimulus plan is set to give stimulus payments to individuals of up to $1,400 which, when combined with the $600 from December’s stimulus deal, will reach the $2,000 for which President Trump has previously called |

|

| Source: Associated Press, EQ Investors |

With the expectation that this new stimulus package will be funded by federal borrowing, market participants are already questioning what the impact of such a large impulse will be for factors such as inflation. Indeed, the implications of this stimulus will be a major consideration for the US Federal Reserve which has committed to keeping interest rates low in the US for the foreseeable future.

In a more normal environment, a central bank would raise interest rates to combat inflation rising above target. But rising rates has the effect of slowing economic growth. This raises the question as to whether the Federal Reserve would tolerate inflation above its target in the short-term to put off economically damaging rate rises and to facilitate the recovery.

Though Biden’s inauguration is due this week, market participants will no doubt be reeling from last week’s market moves which were bookended by data releases revealing December’s contracting labour market and declining retail sales. Indeed, for some, the transition to a new administration that can inject fresh energy into the pandemic response can’t come soon enough.

There is no doubt that 2021 is going to be a wild ride, from potential hitches in vaccine deployment to the new policies ushered in by a new US administration. If you didn’t catch it before the new year, we set out some key themes we’re watching in for 2021.

STAT OF THE WEEK: 92% – the proportion of Brits who believe they are better at complying with Covid-19 restrictions than the national average (UCL).

Data correct as at: 15/01/2021

Contact us

Have a question about investing with EQ? Please email enquiries@eqinvestors.co.uk or call 020 7488 7171, we’re always happy to hear from you.