As I lumbered sleepily into the kitchen on Sunday morning to make a coffee, the sight of heavy snowfall out of the window sent me running into the other room where I drew the curtains and descended into a schoolboy-like state of excitement. But it wasn’t just us in the UK who were able to appreciate snowfall as a rarity. The Algerian town of Ain Sefra which is in the North of the Sahara desert saw snowfall of its own, marking the fourth time in 42 years.

Equity markets set their own records with fresh highs as expectations of Biden’s stimulus plans propelled market optimism. Following his inauguration as the 46th US president last week, the reality of Biden’s $1.9 trillion stimulus package, and a move to reverse the isolationist policies pursued by former President Donald Trump, was welcomed by investors.

Amid a flurry of executive orders (a legal instrument used heavily by Biden’s predecessor) within his first few days in office, President Biden has actioned a wave of climate related policy commitments, the most significant of which is re-joining the Paris Climate Agreement. The implications of this are that the United States is now committed to a net-zero carbon emissions policy by 2050 in line with the aim of keeping global temperature increases below 2°C versus pre-industrial levels. While the European Union, China and other major economies have already made such a pledge, environmental equities may now enjoy yet more tailwinds as the world’s largest economy moves into line.

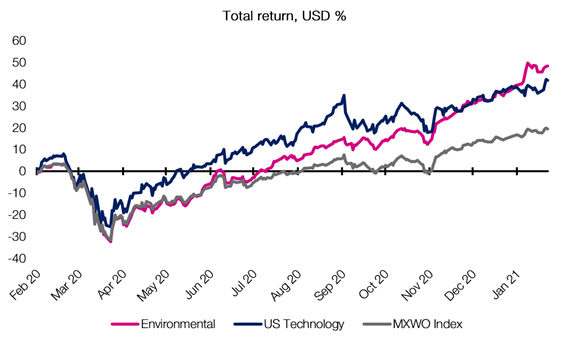

The market impact of this has been quite phenomenal. Figure 1 shows just how the Democrats’ election win, both in the White House (November) and now in the Senate (January), have helped propel the sector not only to fresh highs, but ahead of Technology stocks, which were previously the best performing part of the US equity market.

Figure 1. Recent commitments from the US president have acted as a tailwind for the Environmental sector which has now knocked US Technology off its pitch

Source: Bloomberg, EQ Investors

This comes at a time when large technology firms are facing fresh criticism around their anti-competitive practices, ranging from the Department of Justice investigation into Facebook, the EU Commission’s dealings with Alphabet, and China’s anti-trust probe into business practices from Alibaba. As one prominent UK fund manager has recently commented, these companies that have for years been driving innovation are now having to deal with the challenges posed by their business models. Though there are unlikely to be any immediate consequences from an anti-trust perspective for US technology (antitrust legal battles can be extremely protracted), some commentators have pointed to management teams focusing on such challenges rather than driving new growth.

Only time will tell whether the U-turns last week in American politics will be enough to unpick the impact of policy decisions under the previous administration. One thing is for sure though – the immediate future of environmental stocks looks bright.

STAT OF THE WEEK: 6.35 million – the number of people vaccinated in the UK with at least one dose, over one third of the way to the mid-February target of 15 million (HM Government).

Data correct as at: 21/01/2021

Contact us

Have a question about investing with EQ? Please email enquiries@eqinvestors.co.uk or call 020 7488 7171, we’re always happy to hear from you.