If you’ve ever wondered where the cross over between sci-fi and real life lies, look no further. One of Elon Musk’s lesser known companies, Neuralink, has released a video showing how it has taught a monkey to play a video game with its mind. Pager, a nine-year old macaque with an implanted wireless chip that monitors brain activity, is now able to interact with a computer to play the game Pong as well as ordering “tasty banana smoothie” through a straw. While there are obviously questions around the ethics of putting chips in monkeys, the company’s ultimate goal is to create a brain-computer interface to treat people with brain or spinal injuries.

Despite now being able to order tasty banana smoothies of our own as cafes reopen, we haven’t quite mastered the art of controlling equity markets through our thoughts. Nevertheless, equities did notch another gain last week as the global vaccine roll-out continues to gather pace and emergent data points to a rebounding global economy.

The latest rise in markets comes as the International Monetary Fund, or IMF, has predicted that the most advanced countries will emerge from the pandemic with relatively little long-term economic damage because of extraordinary policy support. This is in sharp contrast to a report also written by the IMF in October in which it warned that Covid-19 could cause lasting damage across the world, with any recovery likely to be “long, uneven and uncertain”. This rosy picture only represents half of the story, however, with emerging countries making up over half of global GDP. Excluding China, the developing world has been hit hard by the pandemic, and both Brazil and India are experiencing significant up-ticks in daily new Covid-19 cases and Covid-19 related deaths.

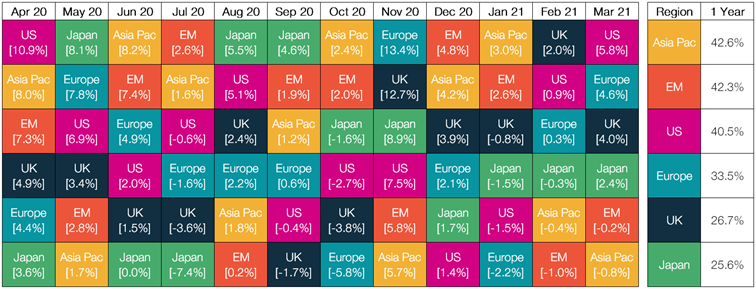

Such divergence among developed and emerging economies has facilitated a shift in the equity market performance league tables. The table below shows that in the year following the initial Covid-19 equity sell-off, emerging markets were among the best performing regions on a month by month basis. However, the slower deployment of vaccine programmes than in advanced economies – partially because there was not the same fiscal firepower to build up a large vaccine order book – is set to put the developing world on a path of significantly slower growth than expected before the pandemic. As such, emerging markets have now slipped down to bottom of the rankings.

| Figure 1. Monthly league table of regional returns show Asian and Emerging Market (EM) equity markets have significantly outperformed developed peers in the year since the equity market sell-off |

|

| Source: Morningstar, EQ Investors |

While global efforts to roll-out a Covid-19 vaccine intensify, there are some commentators who think the main risk from this pandemic is not yet behind us. Tensions are flaring with regards to international vaccine cooperation and there is a risk that national governments could withdraw economic support measures too quickly. As such, the world could be thrust back into a fresh wave of infections or indeed there could be secondary wave of bankruptcies and unemployment. So, as we in the UK emerge into a recovery, a lot of the global economy still looks uncertain.

STAT OF THE WEEK: 74% – the increase in online sales year-on-year in January 2021 (IMRG Capgemini).

Data correct as at: 09/04/2021

Contact us

Have a question about investing with EQ? Please email enquiries@eqinvestors.co.uk or call 020 7488 7171, we’re always happy to hear from you.