Perhaps one day way into the future, onlookers will reflect on the former administration’s decision to create a US Space Force and deem it as Donald J. Trump’s great legacy. One can’t help but think, however, that even this policy decision wasn’t blunder-free. Not only does the logo seem to resemble that of a popular science fiction TV show, but the uniforms were likely designed for combat on Earth and the nomenclature of the personnel was inspired by a popular Marvel film.

It’s not just the US Space Force which is potentially lifting off. There is currently a hot debate around inflation that is grappling markets. Economics classes teach that in normal times, monetary (central bank) policy must be in equilibrium with fiscal (government) policy to avoid runaway inflation. Ready for some more jargon? In other words, monetary policy must be tight (higher interest rates) when fiscal policy is loose (high spending), and that monetary policy must be loose (low interest rates) when fiscal policy is tight (low spending). Hopefully I haven’t lost you yet.

The recent debate around inflation has been sparked due to the announcement of massive government spending packages (i.e. loose fiscal policy) combined with central bank commitments to keep interest rates low (i.e. loose monetary policy). However, contrary to the assumption of all economics teachers, we are not in normal times. In periods of economic stress, it’s not unprecedented for governments to raise spending at the same time central banks lower interest rates as both parties attempt to support the economy. The increase in government spending is often thought to fall into one of two buckets:

- Automatic Stabilisers: systems like unemployment benefit which are automatic because it triggers without the need of extra government action, and

- Discretionary Spending: optional government spending in areas such as defence, health, transportation, or education which can be varied as needed.

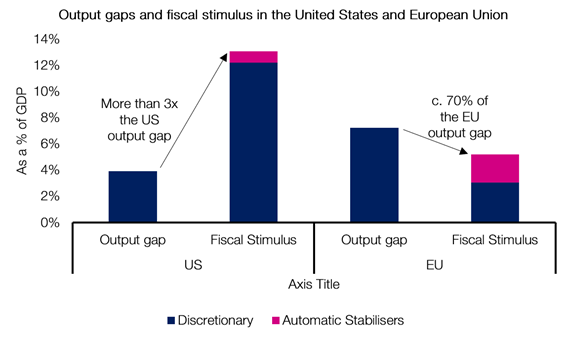

Using a crude measure called the “output gap” we can get an idea of an economy’s current state versus its potential (for example what it could have been had we not had a global pandemic). Based on estimates for the end of 2021, the chart below shows that the output gap in the US is expected to be around 4% (i.e. the US economy will be 4% smaller than where it could be), while in Europe this gap is expected to be nearer 7%. It is this output gap that policymakers should aim to fill with spending, and as such we can use it as a measure to evaluate what sort of impact a stimulus package may have. While a package smaller than the output gap may fail to support the economy enough, a package many multiples larger could risk high levels of inflation.

| Figure 1. As a percentage of GDP, the US fiscal stimulus package dwarfs the European Union in relation to their respective output gaps |

|

| Source: Bloomberg, Unicredit, EQ Investors |

The chart above shows how proposed government spending by European governments covers just 70% of the output gap in Europe, thus risking a weaker bounce back in economic activity than there, arguably, could have been. By contrast, the new US president has proposed a $1.9 trillion stimulus package in addition to the $900 billion of stimulus passed through Congress last year making the aggregate value more than 3 times the size of their output gap. With such a large proportion of this package in the form of discretionary spending rather than automatic stabilisers, it highlights a huge bet by the Biden administration. Only time will tell whether this is the right call.

STAT OF THE WEEK: -0.1% and 0.9% – price inflation in the hotel and restaurant sector in January 2020 and January 2021 respectively. The latter is despite the industry remaining in lockdown. (ONS).

Data correct as at: 21/02/2021

Contact us

Have a question about investing with EQ? Please email enquiries@eqinvestors.co.uk or call 020 7488 7171, we’re always happy to hear from you.