Economic growth

Jeremy Hunt set out an optimistic vision despite a tough economic backdrop. The Chancellor said his package of measures would cut business taxes, raising business investment, and getting more people into work. He made permanent a tax break for businesses that allows them to save on corporation tax by making capital investments in the UK, to support continued growth and investment. He also announced £500m of investment in artificial intelligence innovation centres together with zones for advanced manufacturing.

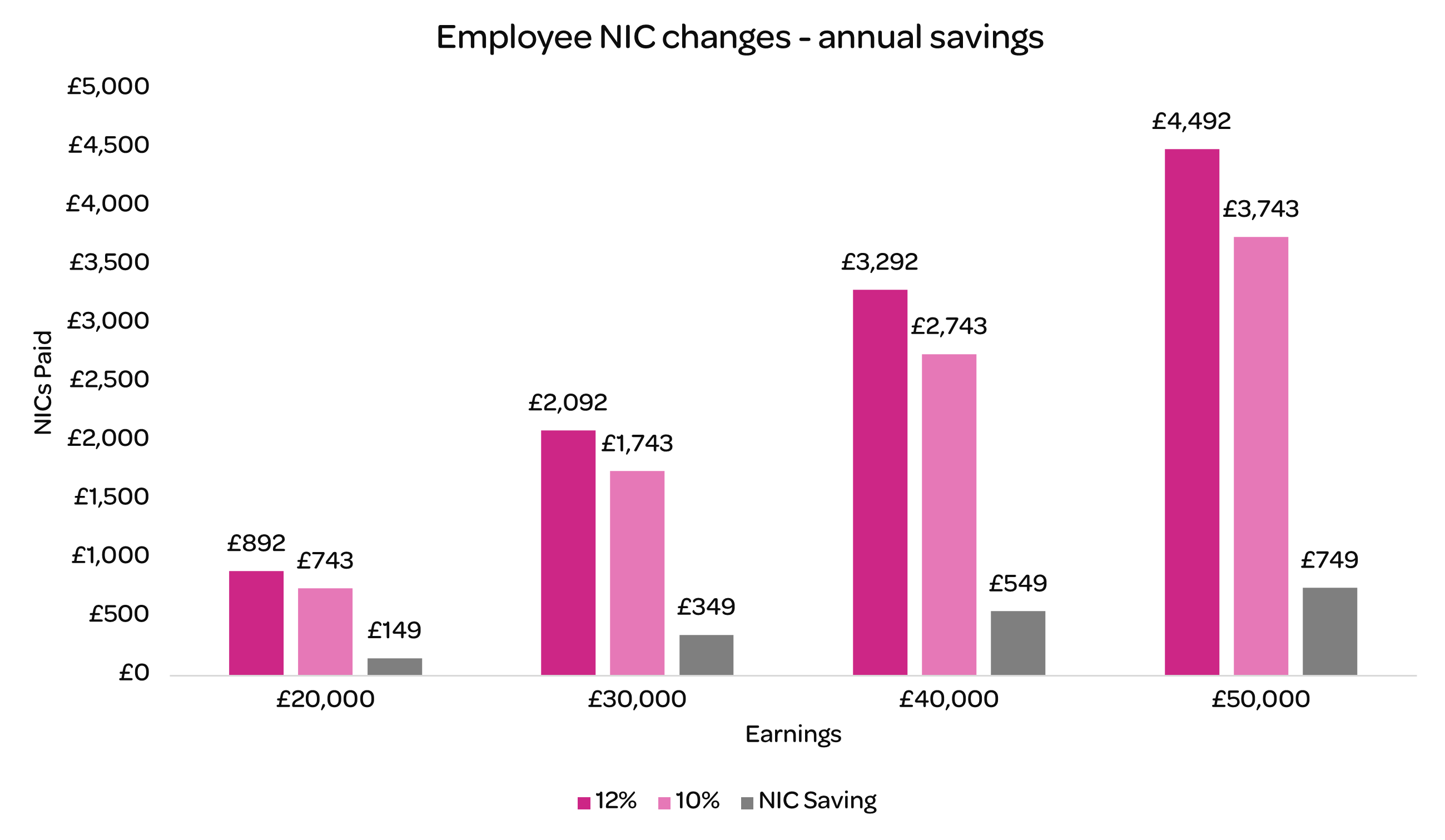

National Insurance cut

The main rate of Class 1 employee national insurance contributions (NICs) will be cut from 12% to 10% from 6 January 2024. The combined rate of income tax and NICs for basic rate taxpayers will be 30%, the lowest rate since the 1980s.

For the self-employed, the Chancellor said he was abolishing Class two NICs entirely from April 2024, saving the average self-employed person £192 a year, but said those who choose to pay voluntarily can still do so. Further steps will be set out next year.

In addition, Class 4 NICs for the self-employed will be reduced from 9% to 8%. These reforms would save around 2mn self-employed people £350 a year.

Despite these cuts, the thresholds at which people pay income tax and NI have been frozen since 2022 and are due to remain until April 2028. Due to the effects of inflation and wage growth, more people have been dragged into higher tax bands, because of the so-called fiscal drag.

Triple lock maintained

The state pension will rise by 8.5% from April 2024 in a move worth up to £900 for some pensioners.

Hence the full State Pension will increase from £203.85 per week up to £221.20 per week (£11,502.40 per annum).

Lifetime Allowance abolished

At the Spring Budget, the government announced it would abolish the Lifetime Allowance (£1,073,100) from 6 April 2024. New allowances to cap tax-free lump sums during lifetime and on death will replace the Lifetime Allowance. Those with existing forms of Lifetime Allowance protections will retain higher allowances. We will be reviewing the rules in detail over the coming weeks.

ISA simplification

Individual savings accounts (ISAs) will be overhauled to enable savers to pay into multiple accounts for the first-time next April, while the current £20,000 tax-free allowance will remain unchanged. The Junior ISA allowance will remain at £9,000 and the Lifetime ISA allowance at £4,000.

This involves digitalising the ISA reporting system to make it more effective, as well as expanding the investment opportunities available in ISAs to include Long-Term Asset Funds and open-ended property funds with extended notice periods.

One ISA to invest in both cash and shares is long overdue, and makes it easier for individuals to pay into, and transfer ISAs between different providers.

This should also increase competition and vastly reduce people’s chances of making a mistake that costs them dear.

Proposals to incorporate fractional shares will feature in a wider consultation. There was no mention of a hotly tipped British ISA.

Workplace pension reforms

Workplace pension savers are to be given the legal right to ask their employer to pay into a retirement fund of their choice under changes confirmed in the Autumn Statement.

By giving savers the choice of where their employer’s pension contributions are directed, the government hopes to raise engagement in and awareness of pensions, reduce the creation of a new small pots every time an individual changes jobs and for individuals to take ownership of their pension savings.

There will be administrative challenges to the proposals for employers. This would effectively be auto enrolment 2.0.

NatWest: Chancellor plots ‘tell Sid’ sale of remaining government stake

The Treasury still owns 39% of the UK high street bank as the result of a £45.5bn bailout of Royal Bank of Scotland as it was known at the time during the financial crisis in 2008.

Over the course of the next twelve months, they will ‘explore options to launch a share sale to retail investors, subject to supportive market conditions and achieving value for money’.

Living wage hike

On Tuesday, the Treasury announced that the national living wage, which applies to workers over the age of 21, will be increased by almost 10% from £10.42 to £11.44 an hour.

Green economy: tinkering at the edges

A £960m Green Industries Growth Accelerator (GIGA) was announced, focusing on funding for carbon capture, hydrogen, offshore wind, electricity networks and nuclear.

This announcement seems to constitute a small-scale support programme for early innovation, vastly different from the scale and momentum we have seen in the US and some of Europe. That scale is necessary to attract private investments and deliver a material impact on driving accelerated decarbonisation in line with the Paris Agreement.

Enterprise Investment Schemes (EIS) and Venture Capital Trusts (VCTs) extension

EIS and VCT legislation have sunset clauses which limit income tax relief to shares issued before 6 April 2025, this will be extended to 6 April 2035 allowing investors to continue benefiting from income tax relief in qualifying companies and investments.

Inheritance Tax unchanged

The Chancellor failed to mention Inheritance Tax (IHT) after rumours of an overhaul. The standard nil rate band (£325,000) and residence nil rate band (£175,000) are currently frozen until April 2028 with IHT charged at 40%.

Further details

The team at EQ will continue to review the changes and their impacts over the coming days and weeks.

Please do get in touch if you have any questions or would like more information.