What are the changes?

In the 2022 Autumn Budget, Chancellor Jeremy Hunt announced changes to the Capital Gains Tax (CGT) system. CGT is payable on the increase in value of assets including investments and property at the point of sale or gift. Main residence properties are exempt from CGT.

The changes will be to the annual exemption amount (AEA) – often referred to as a CGT allowance i.e., the amount of gains you can make in a tax year before paying CGT. In 2022/23 the AEA was £12,300 for individuals (£6,150 for trustees) and this reduced to £6,000 for individuals (£3,000 for trustees) at the start of the 2023/24 tax year.

From the 6th of April 2024, the AEA will reduce again to £3,000 for individuals and £1,500 for trustees.

Capital Gains Tax rates

| Type of asset | Basic rate | Higher rate |

| Shares | 10% | 20% |

| Residential property | 18% | 28% |

Who will be affected?

It is expected that this move will provide an additional £275million of revenue for the Treasury in the 24/25 tax year. Historically, smaller unwrapped portfolios were not liable to CGT as their gains were with the AEA each tax year.

By the 2024/25 tax year, the Government estimates that an additional 260,000 individuals and Trusts may be liable for CGT, that otherwise would not have, had these changes have not been implemented.

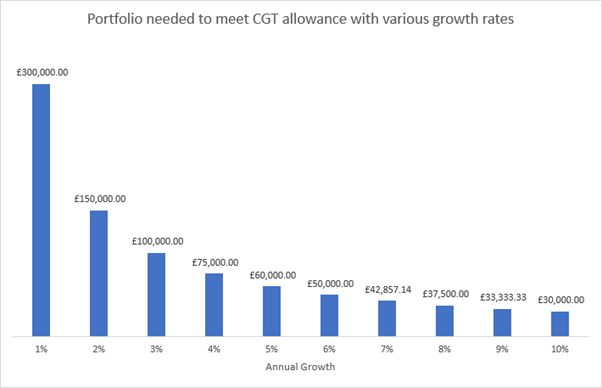

The level of growth in any tax year will have a significant impact on the liability for CGT. The chart below illustrates the value of portfolio needed to use the AEA with various growth rates. From 2024/25, a portfolio of £100,000 will be liable to CGT if growth exceeds 3% in that tax year.

Source: EQ Investors, October-23

When do I pay CGT?

Gains within an investment portfolio will usually be declared on your Self-Assessment. This will need to be submitted and any tax owed to HMRC will need to be paid by the 31st of January following the end of the tax year.

Gains from a property sale such as a second home or investment property need to be paid to HMRC within 60 days.

Are there any ways to minimise CGT going forward?

There are several strategies for reducing a potential CGT liability:

- Be aware of any losses within your portfolio, these can be used to offset any gains. You can carry losses forward to future tax years.

- Remember to make use of your tax efficient allowances each tax year and use your ISA and pension allowances.

- Assets can be transferred between spouses/civil partners without incurring any CGT. Make sure to use both of your CGT allowances each tax year.

- Also ensure that the spouse/civil partner with the lowest tax rate incurs the gains to reduce the level of tax payable.

- Contributing to a pension may move you into a lower tax bracket which means you pay a lower level of CGT.

- Invest money into an Enterprise Investment Scheme (EIS). This can reduce or delay your CGT liability.

If you have any questions or concerns, please get in touch or speak to your EQ Financial Planner.

Please remember, this content is provided for information purposes only. Investment involves risk. Past performance is not a guarantee or indication of future results. Investment return and the principal value of an investment may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability.