Inflation fears

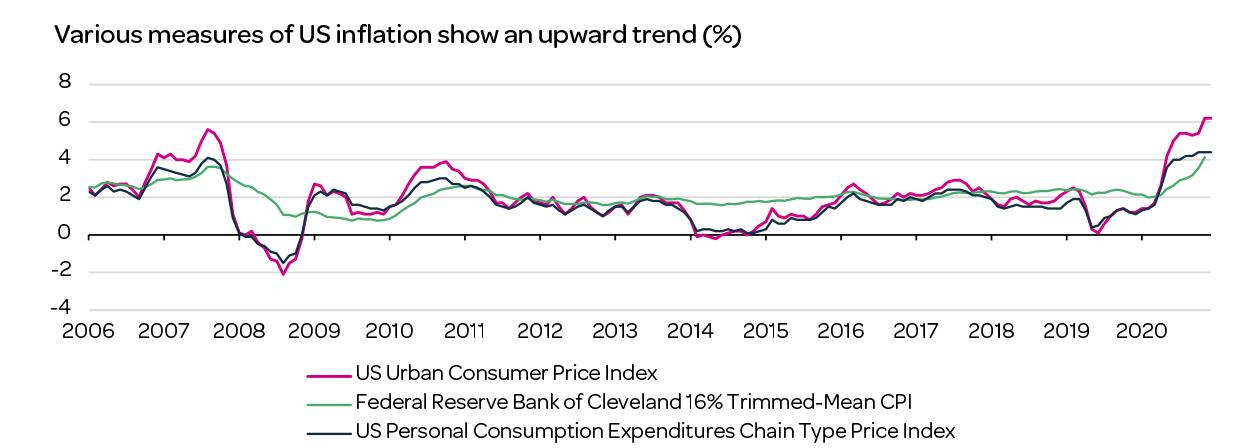

Headline inflation in the US jumped to 6.2% in October compared with a year earlier, as the cost of food, gas, and housing all surged. Americans have not seen an inflation rate this high since December 1990.

Despite some commentators arguing that extreme price changes should be ignored (green line below), the upward trend in various inflation measures shows no signs of abating. The ‘base effects’ that were originally blamed a few months ago have now rolled out of the data, and it is no surprise that investors are wondering if this is the start of a higher inflationary environment.

The potential for sustained inflation is more likely than it has been for a decade for reasons we have discussed previously: the global working age population is peaking, supply chains are shifting from ‘just in time’ to ‘just in case’, central bank to ‘average inflation targeting’. The ‘age of austerity’ is over with governments no longer scared of borrowing.

Finally, major central banks have hinted they want to help tackle climate change. What better way than to maintain low borrowing costs with a bit more inflation?

Managing sustainability risk and opportunities

The final agreement at COP26 is the first to specifically identify coal and fossil fuels as part of climate commitments, so we see this optimistically as a landmark moment. The direction of travel is clear to all of us.

As sustainability risks and opportunities have come into greater focus over the last 18 months, we are seeing improvements in the quality of available data, which in turn means these risks are being better priced by the market. Hence it is more important than ever to invest through fund managers that fully consider these risks and capture opportunities along the path to a more sustainable world.

Portfolio implications

We maintain our strong positive view on growth themes like environmental equities, robotics, and health tech, but since these themes are growth oriented, a large portion of their value is far in the future. This exposes portfolios to a significant headwind from higher inflation. A £1 in the future is worth far less if inflation is running at 5% a year instead of 2.5% year.

This means we need to balance portfolios with companies that have a higher proportion of their value in the present – with things like buildings, plants & equipment. This makes most people think about the energy, materials, and financials sectors. But the various ESG and climate risks of these sectors pose a challenge.

So, one fund launch we are supporting is the Schroders Global Sustainable Value fund. It is managed by the same team that have run Schroders’ value strategies for more than a decade. This new strategy fully integrates information from Schroders’ sustainability tools into the investment decision making process, yielding a portfolio of sustainable companies with a value style bias.

Crystal ball – what will 2022 bring?

We believe technology innovation will be part of the climate change solution, so we expect to see a proliferation of connected devices (the Internet of Things). This will enable more efficient use of energy, buildings and other assets and could create a productivity boom, while lowering climate intensity. As the pandemic has shown us, our global supply chains are vast, complex, and fragile.

As the web of digital connections grows, providing security services to digital infrastructure will be a key area of growth. The pandemic also demonstrated innovation in healthcare and the treatment of diseases.

Advances in simulation technologies are creating new platforms for drug discovery, so we expect to hear about new drug candidates to treat some of the world’s most debilitating diseases. We all have a part to play with mitigating climate change. Could 2022 be the year when we pay more attention to our consumption habits and where nutrition and meat-alternatives take off?

In many respects, the pandemic feels like a turning point and what we do in the years ahead will shape our world for decades to come. In the words of Ernest Hemingway, “It is good to have an end to journey toward; but it is the journey that matters, in the end”.

Want to learn more?

If you want to learn more about investing with EQ Investors, please arrange a call with one of our chartered financial planners.