A quick refresher

Investment trusts are Public Limited Companies (PLCs) that are listed on the London Stock Exchange. Their sole business is to invest on behalf of their shareholders.

Typically, we hold investment trusts within our Bespoke Portfolio Service which gives you access to a broad universe of investment assets.

Investment trusts are sometimes overlooked, but they can have some important advantages over the long-term.

Generally cheaper

Investment trusts have long been committed to low costs and tend to have lower total expense ratios (TERs) than open-ended funds such as unit trusts.

Access hard to reach assets

We particularly like investment trusts as their unique structure allows us to access a wider range of assets such infrastructure and private companies.

An investment trust has a fixed number of shares to buy (a closed-end fund), and fund managers don’t have to buy and sell shares to meet demand. This gives the fund manager more control as they can buy and sell when they believe the time is right.

Borrowing power

By borrowing money (a process known as ‘gearing’), investment trusts can potentially boost returns, though it can also magnify losses as interest rates rise.

Trust structure

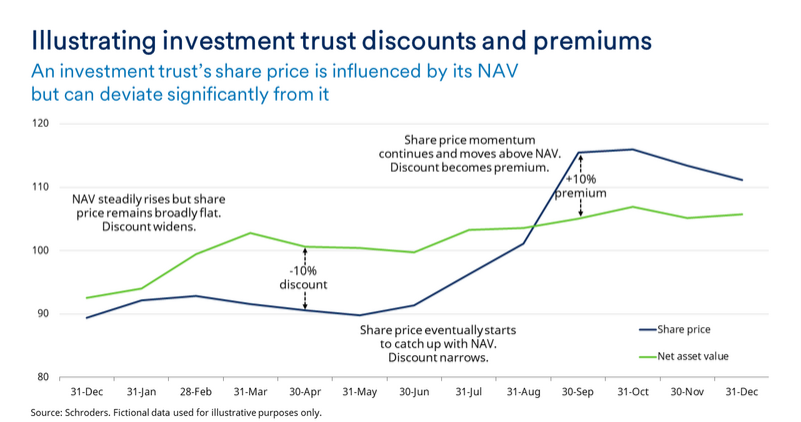

The value of your investment is based on the share price of the investment trust, not necessarily the value of the underlying assets.

Depending on these factors, an investment trust’s share price could trade above the underlying value of the portfolio (at a premium), or below the underlying value of the portfolio (at a discount). This is illustrated in the following graph.

Unfortunately, some of the advantages of the investment trust structure can work in reverse.

A year to forget

2023 was a tough year for investment trusts. The average trust shouldered a double-digit discount, the first time this has happened since the global financial crisis.

Of the 392 trusts listed on the Association of Investment Companies (AIC) website, around 220 lost money. In around a quarter of those cases, however, the trust’s share price has fallen despite its manager achieving growth in the value of its underlying investments.

Investment trusts are also grappling with some structural issues. A consolidating wealth management industry increasingly favours bigger, more liquid trusts, at the expense of the smaller players in the sector.

Discounts persist – but so do opportunities

Despite the negative sentiment and difficult backdrop, earnings and revenue growth are generally remaining resilient in underlying portfolios.

We believe there is a significant opportunity across the trusts we hold. One such example is Greencoat UK Wind.

Due to its strong cash flow, the trust, which is one of the UK’s largest wind farm operators, has remained resilient:

- Plans to pay a 10p dividend in 2024 on a share price of 138p. This dividend has a coverage ratio of 2.1 times.

- Cash flow is inflation linked to energy prices.

- Excellent if you are targeting income or growth, with returns significantly above cash or bonds.

Managing discounts

A unique feature of investment trusts is that they come with their own independent board of directors – and can take action to reduce if it gets too wide.

Last week, the board of the £14bn Scottish Mortgage Investment Trust, announced a £1bn buyback (the largest-ever for an investment trust) to prop up its share price, which is currently at a 13% discount to its net asset value.

In a signal that international investors are taking advantage of the value on offer, Elliot Associates, has acquired a 5% stake. Elliott is known for being one of the largest and most successful activist investors in the world, with a track record of driving significant improvements in the companies it invests in.

Regulatory uncertainty

Another driver of wider discounts has been a change in the guidance about cost disclosures around holdings in investment trusts. The good news is that the government has asked the Financial Conduct Authority to resolve these issues.

On the cusp of a recovery?

Similar periods of historically wide discounts – after the bursting of the dot.com bubble, in the wake of the financial crisis, and in the early days of the pandemic – led to subsequent periods of outperformance by investment trusts.

We continue to engage with management teams and investment trust boards on these topics and will update you with our progress.

Please remember, this content is provided for information purposes only. Investment involves risk. Past performance is not a guarantee or indication of future results. Investment return and the principal value of an investment may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, to determine the risks associated with the investment and its suitability.