As a financial planner, you might think I’d be biased against safe havens such as cash and gold, but that’s certainly not the case. A diversified portfolio helps to manage and absorb market shocks.

Cash and gold both have useful roles to play, particularly during nervous times. Holding cash reduces risk and allows for opportunistic purchases, whilst gold tends to remain uncorrelated to stock markets – meaning they don’t tend to move in the same way at the same time.

Recent market volatility

Looking back over the last few months, you would have benefited from holding either of these assets. Cash would you have provided security during an extremely unsettling period and gold would have made money.

We also need to look at where this cash is held and how it is used in your overall financial plan.

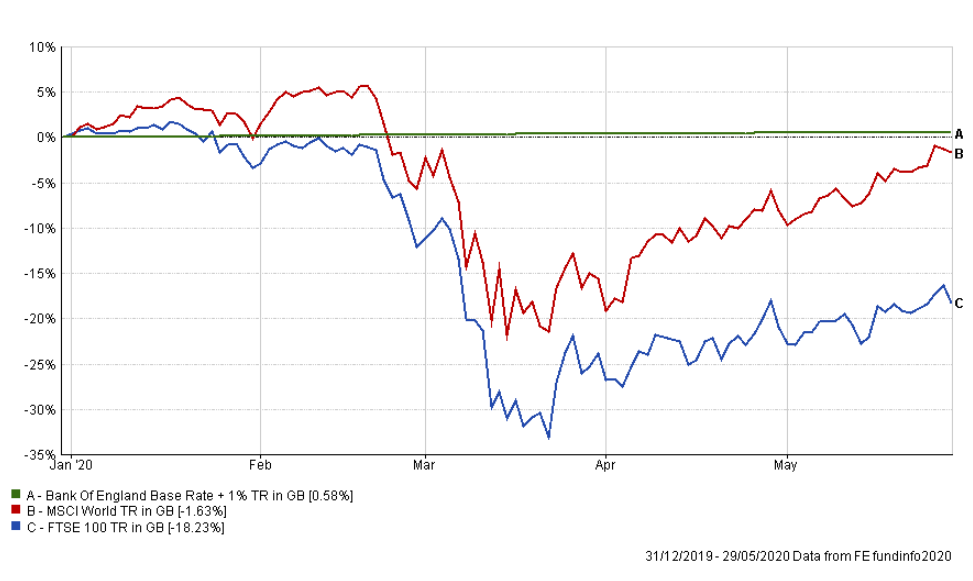

For short term expenses, we want to hold cash, so it is easily accessible. In the chart, you can see the performance of the MSCI World and FTSE 100 vs the current Bank of England Base Rate + 1%. Whilst the MSCI World is nearly back at the level of cash, you might have felt uncomfortable in March and April if this was a ‘rainy day’ fund. You would also still feel uncomfortable if you were invested purely in the UKs largest 100 stocks which still languishes nearly 20% down in 2020.

We recommend holding at least three months income in cash as a reserve. At a time when the furlough scheme doesn’t cover all an employee’s income and there are fears of redundancy, six months would be prudent where possible.

In this part of planning, cash certainly remains king.

Major disadvantage

Cash has a major disadvantage at the moment. Thanks to falling interest rates, it guarantees that you lose money. With inflation hovering around 2% over the last couple of years, this has whittled away the value of your savings that could have worked harder.

Inflation has dipped in February and March following the collapse of oil prices but, it has not yet hit the level of the best instant access savings account. Currently inflation is sitting around 1.5% and the best instant access on the market at the time of writing is 1.16%. You may see this trade-off as rather small if they are risk averse.

When time is on your side

Unsurprisingly, as soon as you take a longer view, we can see that invested assets (such as equities) perform better. The chart shows the MSCI World vs FTSE 100 and the Bank of England Base Rate + 1%. In order to show market stress, I’ve included the 2008/09 financial crisis.

If you only held cash in your pension pot, with the aim of providing income for 20 years or building funds for another 20 years, then it’s unlikely to help you meet your long-term goal.

With a longer-term horizon, cash doesn’t provide the growth you need. The important context here is that the correct strategy is allocated to the right money pot.

Whilst we might want to have more growth assets in a pot designed for the longer term, we may wish to scale down the risk for something we deem to be medium term.

Getting the balance right

Whilst I wouldn’t agree with Ray Dalio’s opinion that ‘cash is trash’, it hasn’t regained the title of king. For long-term investors, it doesn’t provide the real growth that is needed.

Cash remains an integral part of your overall financial plan but shouldn’t be held in excess. Questions to ask yourself include:

- Are you holding cash for additional security?

- Is this your rainy-day money?

- Are you unsure where to invest your cash?

- Are you saving over the long term?

If you’d like help in answering these questions, please get in touch – matt.lewis@eqinvestors.co.uk.