What is financial planning?

Financial planning is the process of taking a comprehensive look at your financial situation and building a specific plan to support your current needs and reach your long-term goals.

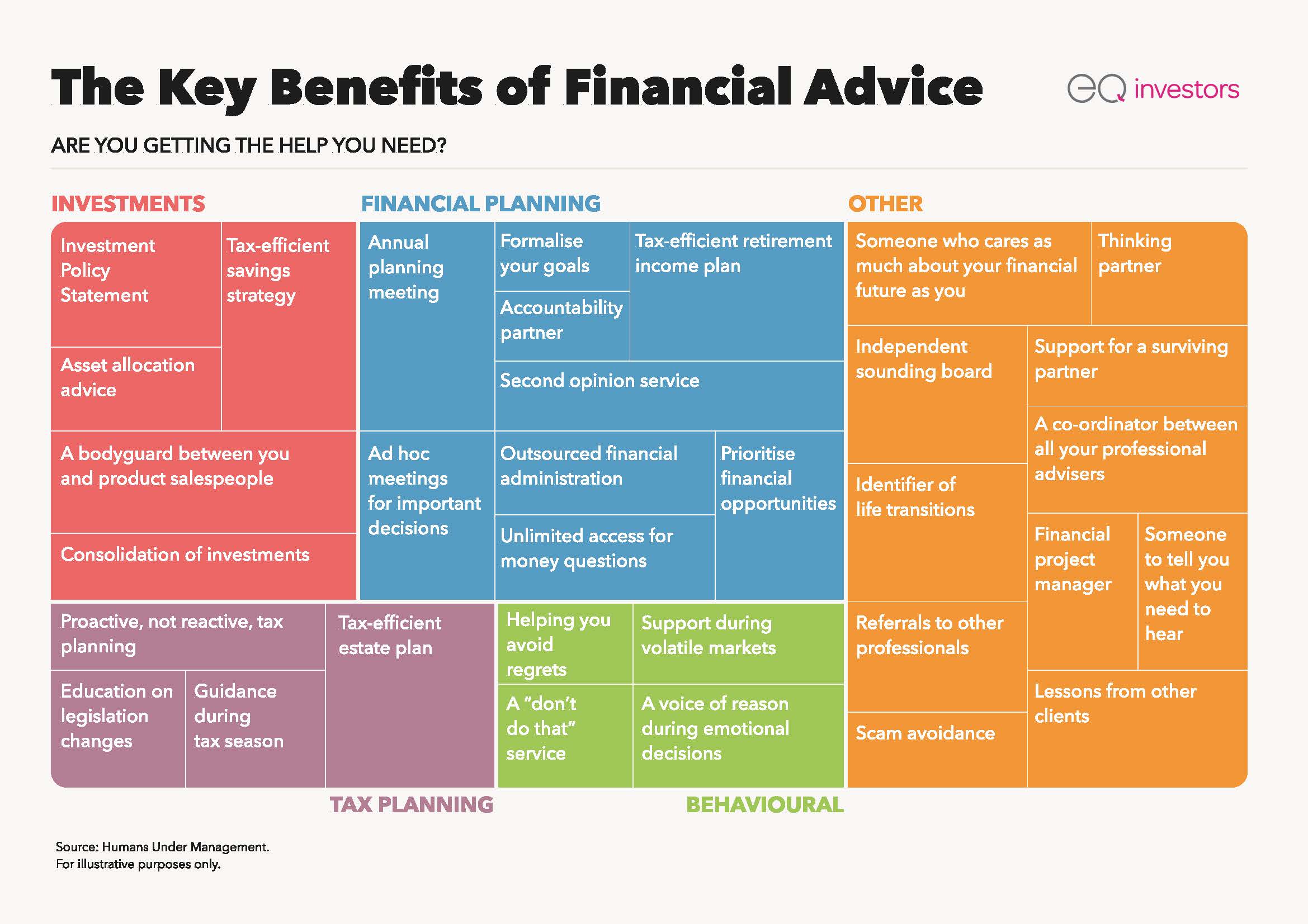

As a result, financial planning often delves into multiple areas of finance, including investing, taxes, savings, retirement, your estate, insurance and more.

What will my financial planner do?

A financial planner focuses on you – your goals, your aspirations, your concerns:

- Build a picture of your current wealth and position.

- Understand your life plan and help you to prioritise your goals.

- Assess possible risks and potential opportunities in your financial life.

- Create a bespoke plan with tailored recommendations to achieve your objectives.

- Provide support to help you implement your recommended plan.

Do I need financial advice?

Financial planning can help to answer some of life’s big questions:

- How much should I set aside for unexpected life changes?

- Will I be able to maintain my lifestyle in retirement or retire early?

- How can I best set up my children for the future?

- Are my investments tax efficient?

- What can I do with an expected inheritance?

- Can I afford school fees for my children?

- Can I afford to move to a bigger home?

- Are my investments set up as efficiently as possible?

- Should I adapt my finances after a divorce, or death of a loved one?

- What should I do after my property or business sale?

These are the kind of questions that we get asked every day.

Our financial planners are trained to sit down with you to explore your needs and priorities – whatever they may be – and then to help you turn that initial conversation in to a fully-fledged financial plan.

How does it work?

During our conversation:

- We get to know you

During this first phase, we want to learn about your future life goals and priorities. We also want to ensure you fully understand what you can expect from us, what we will deliver back to you and how we will become your trusted adviser. - We build your financial plan

Having identified with you what your personal needs and objectives are, we will create your tailored financial plan, which outlines what actions we recommend in helping you to achieve your goals. We believe that working to a plan is essential for your financial success and the financial lifestyle you want and deserve. - We help implement the plan

Our team will help you to implement your plan and invest on your behalf. You’ll never have to worry about what markets are doing, or when to buy or sell. You can check how your investments are doing, online 24/7. You can talk to us whenever you like, and we’ll review your plan every year.

Ethical financial advice

It is our philosophy to build trusted and long-lasting relationships with our clients. Book a free financial planning discussion and we’ll look at your circumstances, identify any gaps and suggest the way forward. From inheritance to investing, pensions to protection, we’ll cover everything that matters to you.

Please remember, this content is provided for information purposes only. Investment involves risk. Past performance is not a guarantee or indication of future results. Investment return and the principal value of an investment may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, to determine the risks associated with the investment and its suitability.