According to a study by Direct Line, only 35% of adults in the UK have life insurance, despite its importance in providing for their families. This translates to roughly 18.8 million people.

Even if you are one of this 35%, it’s also important to review your policy on a regular basis or after a significant life event.

What are life events?

When we think about life insurance, it’s important to remember that the proceeds are for our loved ones.

A life event in the context of life insurance refers to a significant catalyst in your life that can affect their financial situation. Examples include:

1) Having children: Losing half the available income in case of an untimely death could leave the surviving spouse struggling to make ends meet. In fact, 7 in 10 households say they’d have trouble covering everyday living expenses within just months of losing their primary wage earner.

2) Buying a home: Paying off a mortgage is one of the main reasons people buy life insurance. To help keep the people you love in the home they love, you can buy enough life insurance to completely cover that debt.

3) Paying off your mortgage: Decreasing insurance policies are set up to finish around the same time a mortgage is due to paid off and lapse automatically. If affordable, you may look to put a level term assurance policy in place rather than a decreasing policy. A level term policy can provide a sum assured even after the mortgage has been paid off.

4) Divorce: It is important to revisit pre–prevailing life insurance policies after divorce. Where partners have separated with children, the sum assured provided by a pre–existing contract may still be intended to be left to cover childcare, school fees or to leave a nest egg. The complications occur when deciding who pays the premiums and for how long.

5) Retiring: Upon retirement, you may lose death in service or relevant life benefits provided by your employer. If there is still need for life insurance after retirement it is important to consult a financial planner as to what your options may. If older at retirement premiums may be significantly more expensive and cover may have to be reduced to keep premiums affordable.

What constitutes a change in circumstances?

Changes in circumstances relate to events that may give rise to a policy adjustment. For instance, buying a more expensive property may mean that your current decreasing insurance policy will not cover the new mortgage amount in its entirety.

Having children may increase the cover needed and most likely the monthly premium.

As life insurance is medically underwritten, changes to your health status may adjust the premium. For instance, quitting smoking may reduce your premium.

In all occurrences, it’s best to check with the insurer or your financial planner.

Should you review your insurance annually?

In short yes. Checking outstanding policies is always prudent even if the insurance has been taken out to cover the long term.

How do you know if your policy is about to expire?

The expiration date will be stated on the original policy document. Annual reviews of the policy will show the end date and whether the policy can be extended.

Is it worth switching providers?

An annual review of your policy may show that switching providers could result in a cheaper monthly premium. However, there are many potential drawbacks of switching providers. A conversation with your financial planner is recommended.

It’s important to make sure when shopping around that the new insurance policy reflects the same terms as the previous policy. It’s also worth noting that changing providers will result in a new two-year contestability period meaning that if the provider discovers and inaccuracies in the information provided, cover may be denied.

How can EQ help?

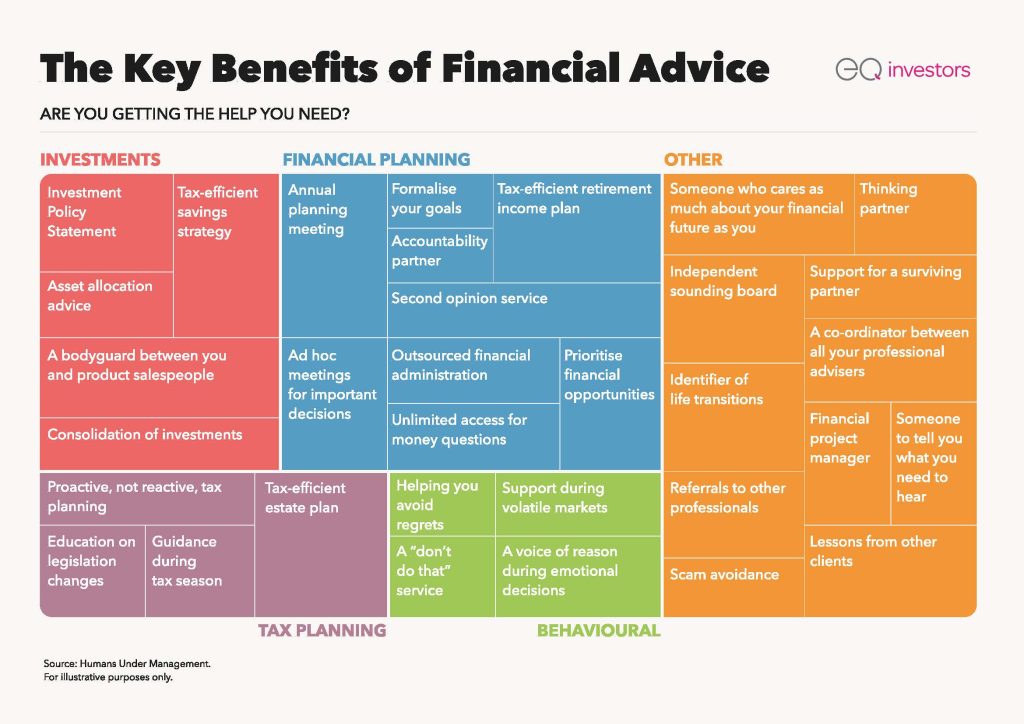

At EQ, we help create comprehensive financial plans tailored to your circumstances and goals.

We’ll review your current position across life insurance, investments, and pensions to identify any opportunities and potential gaps in your financial planning.

Please get in touch to discuss how we can help you build a secure financial future.

Please remember, this content is provided for information purposes only. Investment involves risk. Past performance is not a guarantee or indication of future results. Investment return and the principal value of an investment may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, to determine the risks associated with the investment and its suitability.