Currently you can fill National Insurance (NI) gaps going back to 2006. However, from 5 April, this will change. After that date, you will only be able to plug six years’ worth of missed NI contributions.

Inflationary pressure

Whilst inflation is high for everyone, its impact can arguably be felt more by retirees. Working-aged people can typically expect pay increases each year or bonuses, however, retirees on fixed incomes have far less control over fluctuations in income demands and instead may need to look for ways to reduce their cost of living.

Background

At times like these an inflation-proofed income is worth its weight in gold. One such income that most of us can expect to receive is the State Pension. The full State Pension is currently £185.15 per week and is proposed to rise to £203.85 from April 2023. To qualify for the full State Pension, you must have paid National Insurance Contributions (NICs) or received NICs credits for 35 years.

The government recognises that some individuals may have gaps in their NICs record for a variety of reasons. As such, they provide the opportunity to purchase additional years to ensure an individual can obtain the full State Pension at State Pension age.

National Insurance Contributions and Entitlement

When the new State Pension was introduced in April 2015, the years needed to qualify for the full State Pension changed from 30 to 35. In acknowledgment of the government moving the goalpost they allowed a small window for men born after 5 April 1951 and women born after 5 April 1953 to purchase additional years NICs going all the way back to 2006 to assist in obtaining the full State Pension.

What you need to do

The first step is to assess if there are any gaps in your NICs record. To do this you need to obtain a state pension forecast online. This will confirm if you have already accrued entitlement to the full State Pension or are likely to do so by State Pension age. If you do not have full State Pension entitlement, then you need to check your NICs record for ‘incomplete’ years. You will find a link to your NICs record on the State Pension forecast statement.

If you have gaps in your NICs record you may qualify for free credits to complete these. Broadly speaking, you may have entitlement to these if you have ever claimed benefits, been a low-income earner or carer. You can find out if you qualify by contacting the HMRC on 0300 200 3500 and requesting a formal top up quote. HMRC will then provide a reference and bank details for you to transfer the money to them or you can send a cheque.

The cost of Purchasing Additional State Pension

Now that you know the position of your State Pension, you can consider the value of maximising it. The current cost of purchasing extra State Pension is £824 per £275 of annual State Pension income. Considering average life expectancy of 86, the State Pension may be payable for 19 years. Assuming inflation at 2%, your purchase of £275 annual income for £824 could provide you with £6,682 of income over an average lifespan.

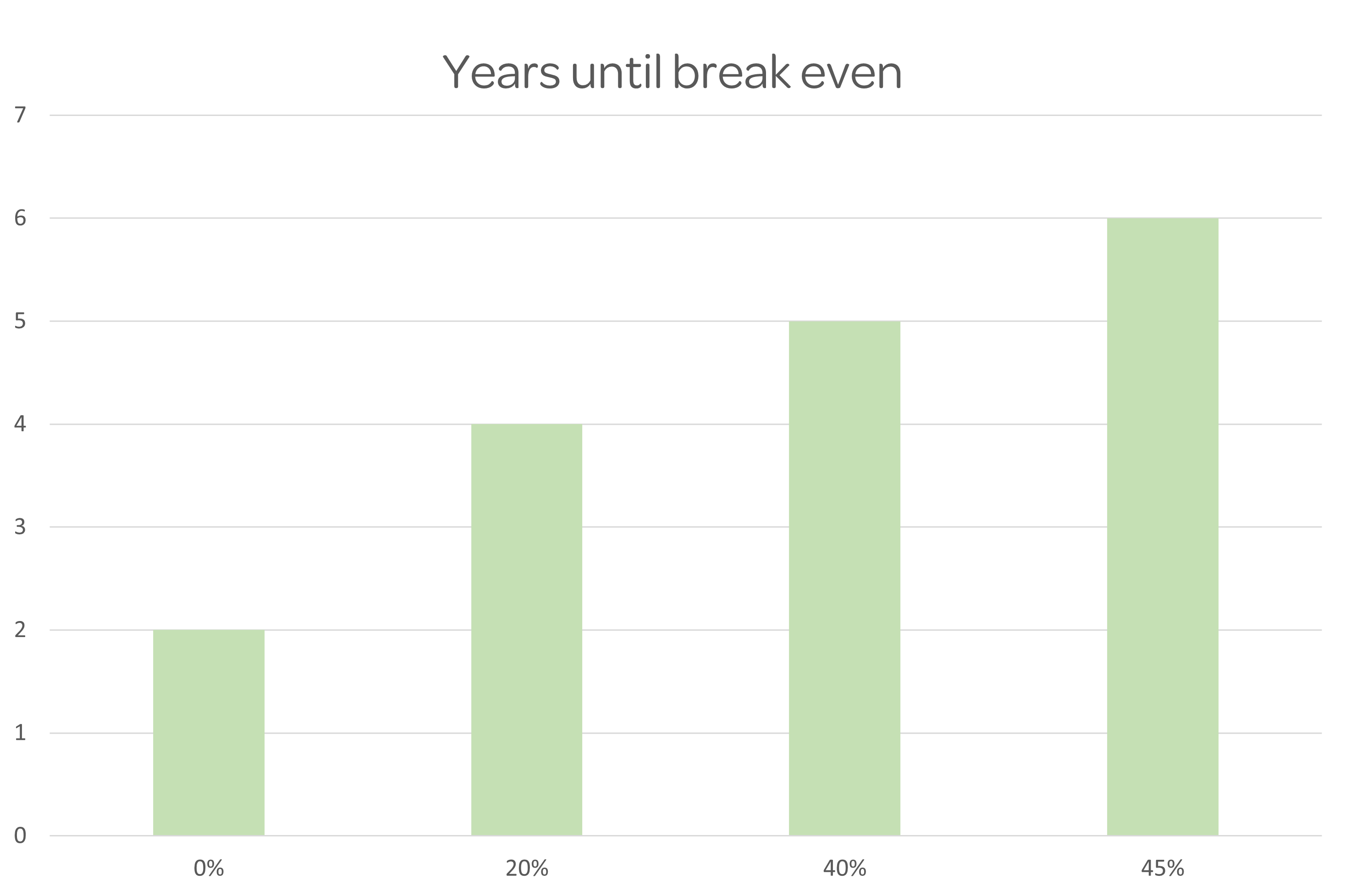

The chart above shows that it would not take long before the extra income from the State Pension is higher than the amount paid upfront. It would take somewhere between three to six years depending on your tax bracket.

There is no blanket answer; everyone’s circumstances are different. If you need help with this decision, then please do get in touch.