We have seen a phenomenal period of market turmoil since the launch of the EQ Future Leaders Portfolios, the likes of which we could never have predicted. Notwithstanding the current situation in Eastern Europe, the global pandemic served as a perfect example of a black swan event that took investors – and the world – by surprise. And yet, two years on, we are extremely pleased to celebrate the anniversary of the portfolios’ launch.

In 2019, we looked to respond to growing demand from our clients to develop a sustainable investment solution but without the fees associated with active management. Before we could launch the portfolios, we had to engage with underlying asset managers to design and launch the type of passive sustainable products that would satisfy our high ambitions. We then prepared for the launch of the unique, sustainable passive-only portfolios at the end of February 2020 – to be met with the 8th largest market drawdown of the last 100 years! And yet despite the backdrop of a global pandemic and the surrounding uncertainty, the portfolios have delivered, both in terms of sustainability and performance, while also achieving on the ambitions of a low portfolio cost.

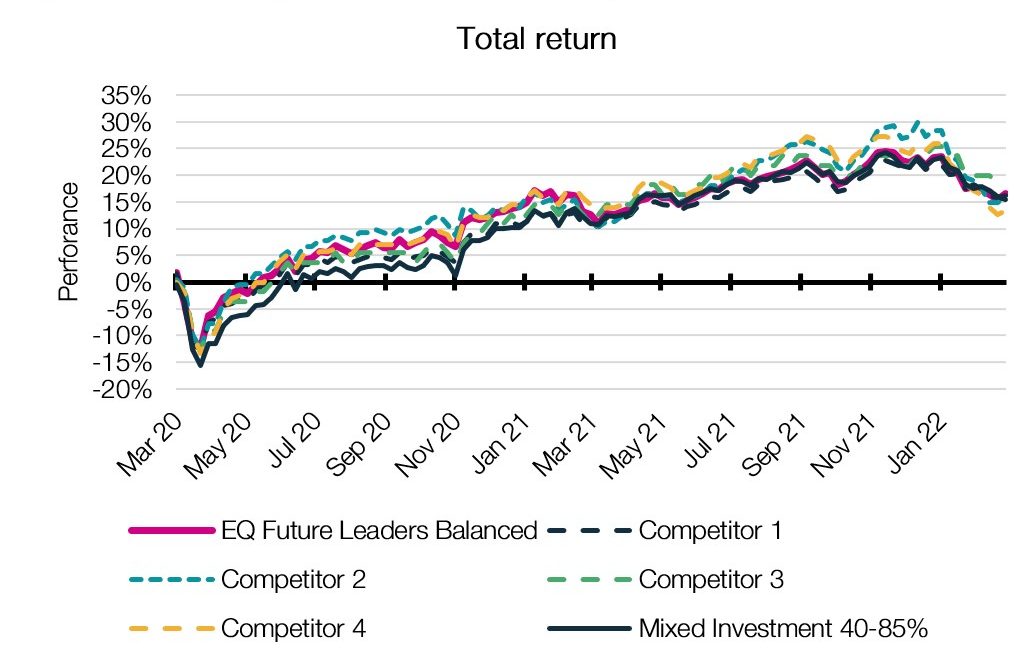

The following chart highlights the EQ Future Leaders Balanced portfolio against a select number of well-known industry peers, both sustainable and non-sustainable, and both active and passive. While our strategy has performed approximately in line with the IA Mixed Investments 40-85% Equity peer group, we have achieved a much lower volatility since inception meaning our risk-adjusted performance is one of the best in the peer group. But how have we managed to achieve this lower level of market risk while still delivering on returns?

Figure 1. Portfolio performance since inception

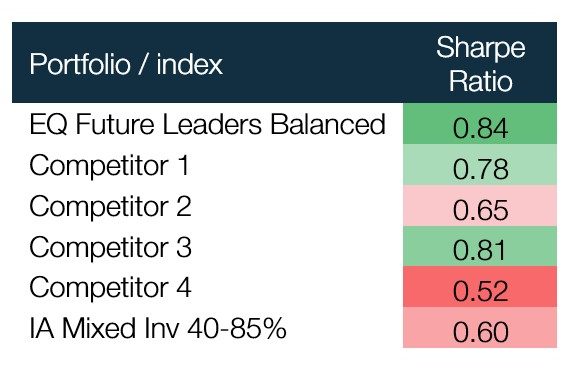

Figure 1 uses weekly data from 2 March 2020 to 28 February 2022, calculated in GBP. Figure 2 uses monthly data from 1 March 2020 to 28 February 2022, calculated in GBP. EQ Future Leaders Balanced performance is net of underlying fund charges and net of 0.25% EQ investment management fee. Source: Morningstar, Bloomberg, EQ Investors

Figure 2. Competitor Sharpe ratios

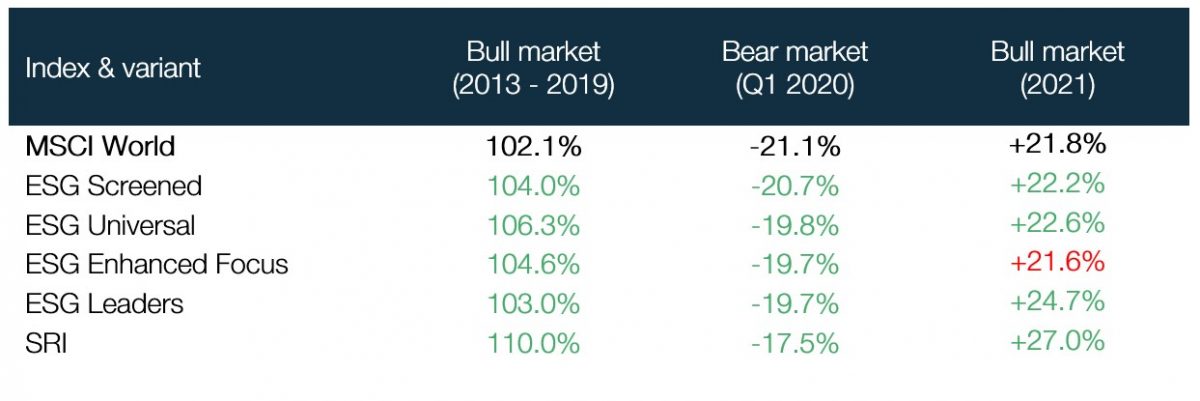

We’ve talked a lot in the past about the benefits of systematic ESG integration within an investment strategy, and we believe the EQ Future Leaders Portfolios are key beneficiaries of this. The following tables break out performance of MSCI indices with varying levels of ESG integration, from the light touch ESG Screened variant through to the more robust Socially Responsible Investing (‘SRI’) variant that forms the core of the EQ Future Leaders Portfolios. As ESG leading companies are generally better managed and are of higher financial quality than the broader market, we find that these companies tend to outperform during both periods of market drawdown and bull markets.

Figure 3. The various shades of ESG

Figure 4. How ESG trades in a crisis

Data from 31 October 2007 to 31 March 2020. Performance is calculated in USD.

Source: MSCI, Financial Express, Morningstar, Bloomberg, UBS Asset Management, EQ Investors

Particularly within sustainable investing, resting on one’s laurels risks falling behind. That is why we have continued to push our underlying asset managers to improve in the two years since launch. We are immensely proud of our engagement work with Amundi which resulted in the exclusion of fossil fuel companies from their Socially Responsible Investing (‘SRI’) index fund range. Meanwhile, we have made several portfolio decisions to develop exposure to sustainable satellite themes, which are aligned to the UN Sustainable Development Goals, and which reflect our evolving understanding of the space. These sustainable themes have expanded since the portfolios’ inception, and now range across clean water, decarbonisation, healthcare, and digital security.

The latter theme is one of the most interesting (and perhaps topical) changes we have made in recent months. While the digitisation of the global economy has untold benefits around factors such as productivity, it creates a new battle ground upon which cybercriminals and authorities are clashing. According to Cybersecurity Ventures, global cybercrime costs are forecast to grow by 15% per year of the next five years, reaching more than $10 trillion by 2025. We think that companies providing solutions to this growing theme are bound to benefit from the increase in digital security spending as companies and governments allocate higher budgets.

While the last two years have undoubtedly been uncertain for markets, we are resolute in our belief that well managed, ESG leading companies that form the bedrock of this strategy will continue to deliver for us. Additionally, our carefully selected sustainable themes are experiencing unwavering growth and are exposed to long-term secular trends that cut through the noise of geopolitics or macroeconomics. We will therefore continue to embrace market uncertainty, hold true to our philosophy, and look forward to celebrating the portfolios’ birthday in another year’s time.