In what is the latest dispute around claims of global intellectual property theft, Marks & Spencer has lodged a legal complaint against Aldi for infringing the trademark of its Colin the Caterpillar cake. Stop the presses. Colin the Caterpillar, the eponymous office birthday cake filled with milk chocolate and buttercream, was first seen in M&S stores almost 30 years ago but now faces a plethora of other larvae shaped companions from other supermarkets. For anyone thinking all caterpillar cakes taste and look the same, Twitter user @tonywilson01 has shared a graphic of how this is not the case…

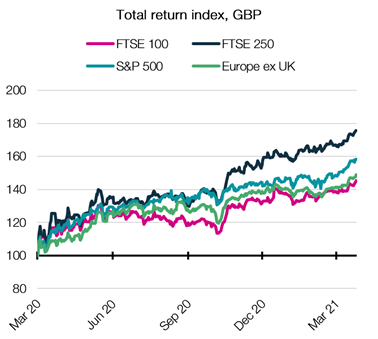

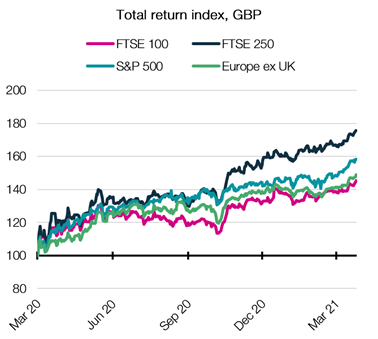

Long described as an out of favour market, domestic UK equities represented by the FTSE 250 have enjoyed a rare moment in the sun having emerged from a cocoon to be one of the top performing equity indices over the past year. This follows the index suffering one of the steepest declines last March, at the height of pandemic fears. This recovery comes as the UK’s vaccine programme has administered around 43 million jabs, bringing the UK’s doses per capita up to 64% and the share of population fully vaccinated up to circa 15%. With the index now back in the black, it’s clear that investor sentiment is turning.

| Figure 1. UK equities have been some of the hardest hit in the pandemic… | Figure 2. … but with a successful vaccine roll-out, domestically focused equities have rebounded |

|

|

| Source: Morningstar, EQ Investors |

As mentioned, the driving force behind this rebound in domestic UK companies has been a successful vaccine roll-out which the IMF expect will reduce the potential of economic scarring (i.e. long-term economic damage). But with the UK-EU trade agreement now in place, UK corporate profit growth set to be one of the highest in Europe, and attractive relative valuations, it’s clear that the case for domestic UK equities could go further.

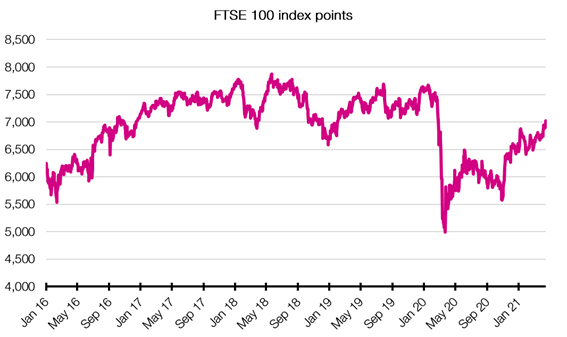

This narrative contrasts with large cap equities, however, with the FTSE 100 (an index that is dominated by large-cap multinational companies) still below its pre-pandemic levels. There are several contributors to this. One reason is that the FTSE 100 is dominated by numerous pro-cyclical sectors such as energy (BP and Shell), mining (Glencore, BHP, Rio Tinto), and banks (Barclays, HSBC and Lloyds) which means the index suffered going into last year’s sell-off. Another is that with sterling denominated revenues making up just a small fraction of the FTSE 100’s revenues, the index is verry sensitive to currency movements and an appreciating sterling has therefore been a headwind.

| Figure 3. While mid-caps have rebounded, the UK’s blue-chip FTSE 100 index remains below its pre-pandemic levels |

|

| Source: Morningstar, EQ Investors |

Nevertheless, flows into UK equity markets are undoubtedly lifting the FTSE 100 as investors seek the more “value” (pro-cyclical) orientated sectors which are heavily represented within the UK. As economic lockdowns continue to be lifted, it’s becoming increasingly possible that UK equities may wriggle themselves off the list of investors’ least favourite assets.

STAT OF THE WEEK: 79% – increase in restaurant bookings on April 12 compared to the same day in 2019 (ONS).

Data correct as at: 16/04/2021

Contact us

Have a question about investing with EQ? Please email enquiries@eqinvestors.co.uk or call 020 7488 7171, we’re always happy to hear from you.