Over 90,000 one cent coins were left at the bottom of a man’s driveway in Georgia, United States, to cover his final payslip. Accusing his former employer of a “childish” move, Andreas Flaten has been left to clean the coins which were covered in an oily, greasy substance.

Equity markets also had a slippery week last week amid a fire sale of about $20 billion of Chinese and US stocks. Energy markets also saw some volatile trading as a giant container ship became stuck in the Suez Canal, blocking a major East-West shipping route. Nevertheless, upbeat economic data in the US helped push stock markets to finish the week in positive territory.

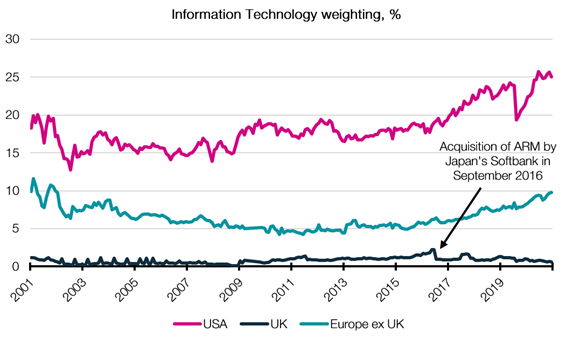

One of the largest stories in UK equity markets at the moment is the upcoming Deliveroo initial public offering (IPO), set to be the UK’s largest IPO since Glencore in May 2011, and the largest technology IPO in London to date. The IPO represents a major win for the London Stock Exchange which in recent years has lacked any serious technology listings, rendering the UK market less attractive for investors seeking highly innovative businesses. There are a number of reasons for this, ranging from foreign acquisitions (such as ARM’s buyout in 2016) to private UK tech companies being lured to foreign exchanges, with the most recent example being Cazoo, a UK car retailer, set to float on the New York Stock Exchange with a valuation of $7 billion.

| Figure 1. While the US and European equity indices have seen rising exposure to Technology-related companies in recent years, the UK’s market lacks any global champions |

|

| Source: Morningstar, EQ Investors |

So, surely UK investors are now jumping for joy at the prospect of Deliveroo going public here at home? Well not so much it seems… In what is perhaps one of the clearest examples of how institutional investors are becoming increasingly conscious of ESG factors (risks related to Environmental, Social and Governance aspects of an investment), a number of prominent asset managers are set to shun Deliveroo’s record IPO.

Considering ESG factors when making investment decisions isn’t exactly new. Indeed, most would argue that it’s prudent to reduce risk by divesting from companies with a history of bribery or corruption, a poor track record of disposing of hazardous waste, or those who regularly infringe on established labour practices and workers rights for example. In each of these scenarios, management teams not only risk reputational damage, but also risk incurring financial penalties which will negatively impact shareholder capital. The proliferation of nonfinancial data from MSCI, Sustainalytics, S&P and other data providers has been a boon to many investors seeking to understand how ESG risks or opportunities may affect an investment case given ESG analysis’ more qualitative nature.

In light of a landmark ruling by the UK Supreme Court (BBC: Uber drivers are workers, not self-employed, Supreme Court rules) that has significant implications for the future of the UK’s gig economy, some investors are now questioning whether Deliveroo’s employment practices (where its riders are classed as self-employed) is a social risk from an ESG perspective. In addition, many prospective investors are unhappy with the proposed governance (another ESG factor) in which Deliveroo will utilise a dual share class structure, enabling its founder to retain control over the business for the next few years.

Following a fantastic year for the company which has seen bumper growth due to the pandemic, there is no doubt Deliveroo’s IPO is set to make headlines. But the loss-making company faces an uphill battle to convince investors increasingly considering nonfinancial factors that it will be a good corporate citizen.

STAT OF THE WEEK: 0.62% – the proportion of the UK equity market classified within the “Technology” sector.

Data correct as at: 26/03/2021

Contact us

Have a question about investing with EQ? Please email enquiries@eqinvestors.co.uk or call 020 7488 7171, we’re always happy to hear from you.