It’s encouraging to see the high street shop Shoe Zone has a sense of humour as it announced a Mr Terry Boot would be taking over from Mr Peter Foot as the next finance boss. I’m resisting the urge to shoe-in a pun here. While the market has been walking all over Growth investors over the last few weeks, it’s useful to contextualise just how painful 2020 was for their Value investor counterparts.

Just to explain what I mean by these terms, Growth investors are characterised by their investment in companies that are earlier in their business life cycle, typically with high growth rates and high valuations. These sorts of companies often sit in more innovative sectors such as Information Technology or Consumer Discretionary. By contrast, Value investors traditionally seek out more mature companies with lower valuations in the hope that they will re-rate at some point in the future. These sorts of companies often sit in more economically sensitive sectors such as Financials or Energy.

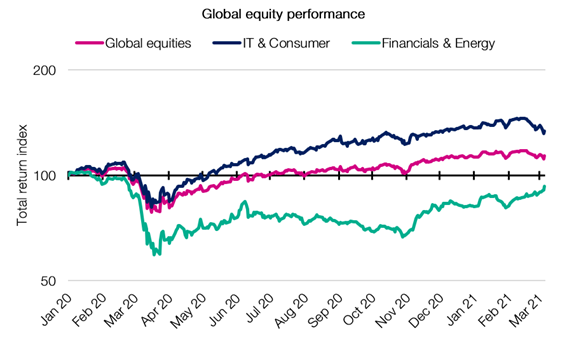

| Figure 1. IT & Consumer stocks which typically appear in Growth investors’ portfolio significantly outperformed Financials & Energy, which themselves frequently appear in Value investors’ top picks |

|

| Source: Bloomberg, EQ Investors |

As we have mentioned many times over the last year or so, we have observed a bifurcation in the markets between those companies that have been boosted by Covid-19 and those weakened. In broad terms, this has followed down the lines of Growth and Value. The chart above shows just how well Growth investors fared in 2020 as demand for online services, new technology equipment and other such products all surged as the economy moved to a virtual setting. Meanwhile, a collapse in travel and leisure, a slowdown in industrial activity and a fall in interest rates contributed to last year’s declines in Energy and Financials. From a performance perspective in 2020, an investor in Technology & Consumer stocks would have been 68% better off relative to an investor owning Financials and Energy.

However, the recent advent of Covid-19 vaccines and the execution of rollout programmes combined with a new US administration set to pass a historic stimulus package has shifted market sentiment not just towards an economic recovery but towards a more inflationary environment with rising interest rates. This has been a boon for the Oil & Gas and Banks sectors respectively, and both have seen significant share price rallies since the start of November. As we touched on last week, the prospect of higher interest rates has caused a tiny tantrum in markets whereby the shine has started to come off 2020’s strongest performers. But as the chart shows, these higher Growth companies are still significantly ahead of their Value peers over the year. Indeed, while the Growth investor will be up some 35% since the start of 2020, the Value investor will still be nursing a loss of almost 10%.

The question for investors now is whether markets have overegged the risk of inflation and therefore expect bond yields to fall back down (which is likely to provide support for Growth equities), or whether we are only at the start of a recovery and that there is still some way for bond yields to rise (which should be accretive to those owning Value stocks).

STAT OF THE WEEK: 22 to 31 – the global median age in 1970 and 2019 (Our World in Data).

Data correct as at: 05/03/2021

Contact us

Have a question about investing with EQ? Please email enquiries@eqinvestors.co.uk or call 020 7488 7171, we’re always happy to hear from you.