A plastic surgeon in the US is being investigated after he attended a virtual court hearing while apparently operating on a patient. The doctor, who was due to appear before a judge for a traffic violation, reportedly turned up on the Zoom call in an operating room and wearing surgical scrubs. When asked, he confirmed he was mid-surgery and continued to work while he waited for the trial to begin.

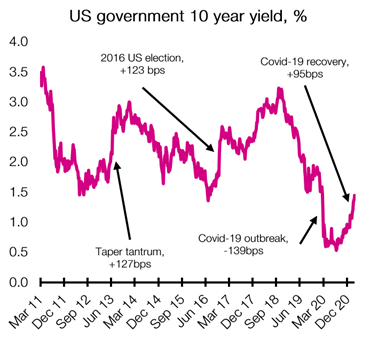

Policymakers at the US Federal Reserve required surgical precision last week as they sought to soothe market angst around rising inflation expectations and the potential for rising interest rates. We touched on the theme of rising inflation in last week’s blog and it seems markets have finally caught up with this narrative. Following the extraordinary moves in bond markets, US government borrowing costs have risen from 0.91% at the start of the year to over 1.40%.

While a borrowing rate of 1.40% is indeed still low in a historical context, large moves can have a severe impact on equity markets. This is because risk free assets (i.e. government bonds) play a key role in deciding discount rates used within calculations to determine how much shares in a company are worth. This means that as government bond yields rise, valuations will fall, and conversely, when government bond yields fall, valuations will rise.

| Figure 1. US Government bond yields have risen from their lows in recent weeks… | Figure 2. …partially driven by an explosion in inflation expectations |

|

|

| Source: Bloomberg, EQ Investors | Source: Bloomberg, EQ Investors |

For some, the moves in recent weeks have been reminiscent of the Taper tantrum in 2013 (marked on the chart above) where US treasury yields surged in anticipation of a slowdown in the Federal Reserve’s quantitative easing programme. At this point, the Federal Reserve had become a major purchaser of US treasuries following the global financial crisis, so the prospect of a support for the treasury market disappearing spooked investors.

There are certainly parallels between 2013 and now. US government bond yields have risen sharply in anticipation of a strong economic rebound and therefore a withdrawal of monetary stimulus by the Federal Reserve. This is despite commentary from the central bank stating that they are looking to keep interest rates lower for longer to stave off further economic weakness.

But some investors are questioning just how much further this move in government bonds can go. Indeed, the likelihood of an extended economic boom or sustained inflation over a long period following the Covid-19 crisis is relatively low. Developed economies will face the same headwinds that were present before the crisis such as aging populations, technological disruption, and globalisation. Nevertheless, the wave of stimulus over the past year and the increased likelihood of inflation in the short-term may make government bonds less attractive in the near-term.

STAT OF THE WEEK: 58% – the proportion of people who have left payrolled employment in the last year who are under age 25 (ONS).

Data correct as at: 26/02/2021

Contact us

Have a question about investing with EQ? Please email enquiries@eqinvestors.co.uk or call 020 7488 7171, we’re always happy to hear from you.