There are many ways of thinking about retirement. Rest, relaxation, remedying time misspent, renewal, and rejuvenation might be some of the aspirations we have. However, retirement is also a race. Not between aging athletes, but between you and your money. It’s a matter of life and death, and our money!

Mark Twain is apparently one of the few people to have ‘correctly predicted’ their death. A year before his death he is said to have drawn parallels with Halley’s Comet which appeared when he was born – “it is coming again next year, and I expect to go out with it”! His great prediction might have been helped by having been ill for some time, so we should probably remember his literary skills instead.

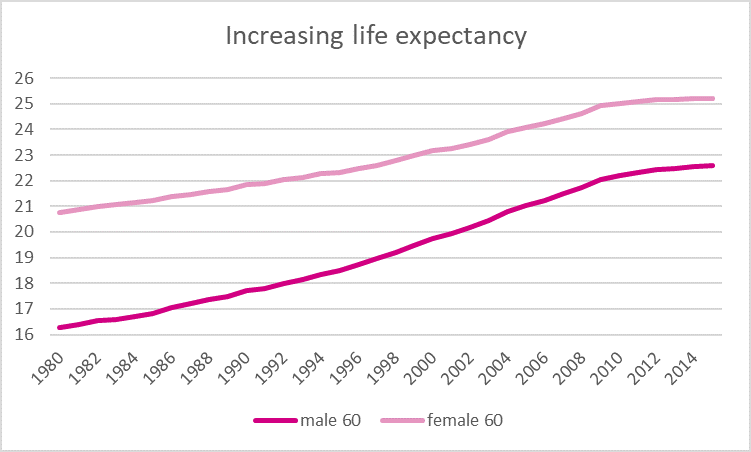

So could we do better than Mark Twain? Halley’s comet tends to return to the Earth’s vicinity every 75 years which would give any 60 year-olds reading this, around 15 years to live. The chart below shows that average life expectancy data from the Office of National Statistics suggests that this is probably an unwise way of thinking! Improvements in healthcare, the environment and the economy have resulted in a significant increase in life expectancy for both men and women.

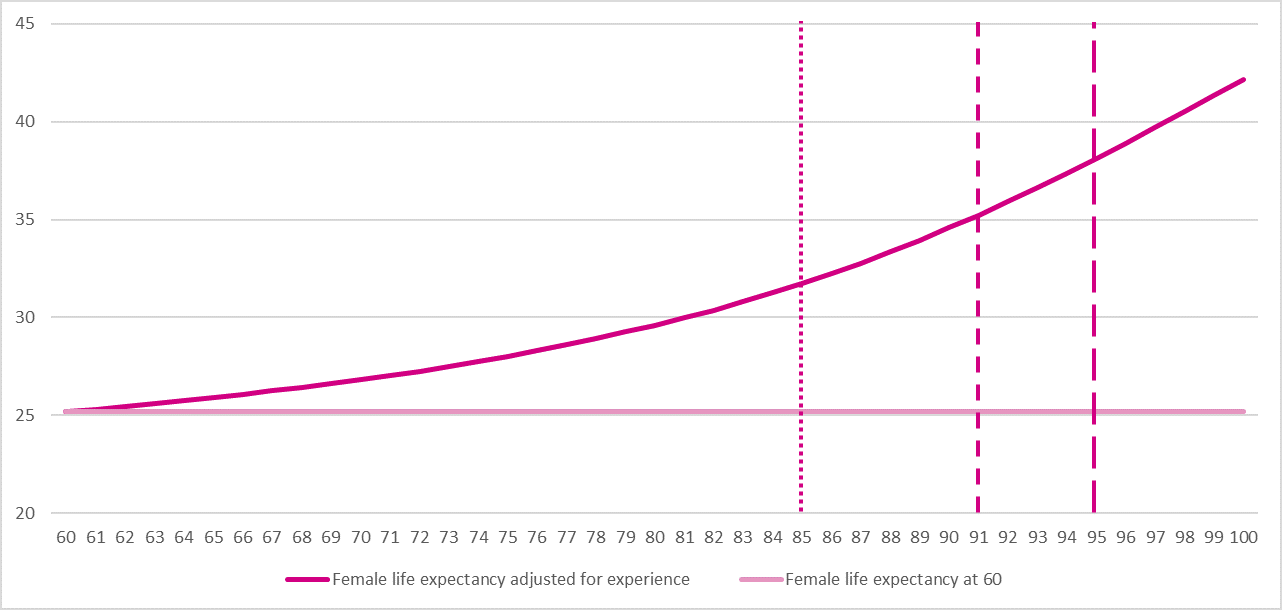

Our big problem in our race against our money is that as we live longer our remaining life expectancy increases. At age 60 a woman could, on average, expect to live at least to age 85. However, if she gets to 85 she becomes part of the ‘average and beyond’ part of her peer group. From this group she’s expected, on average, to live to at least age 91. At age 91, only c24% of her original peer group are still alive and she will have enjoyed an extra six years. I’ve picked out these points in the chart below. The trend is similar for men, but they are not expected to live quite as long.

So, what does this mean for you? Few people will know whether they will live longer or shorter than the average person. Aside from the passage of comets it’s very hard to say – unless you have a serious life reducing condition. We have seen that if you live long, you could live significantly longer than you expect.

When we work we can save excess income for future spending, seek out a pay rise, or move to a cheaper area. We can put our human capital to work or make temporary adjustments to our lifestyle to ‘ride out’ the storm. As a result, we are likely to be able to borrow money if required (e.g. mortgage or business loan).

However, when we retire our resources are limited – especially if we do not intend to return to the workplace. Our expenses might be different to our working life and may well change over time. Unexpected bills like replacing the boiler still arise in retirement. We may also need to make provision for the future cost of practical support in our homes, or a more formal care setting. We are reliant on the wealth we have built up.

Do we have enough and will it last long enough? What might happen if things don’t go to plan (such as investments falling in value). There’s so much to take into account and so much at stake. Once we retire our options for life experiences increase, but our options for wealth replenishment reduce.

Whether you plan to leave an inheritance, or not, it’s important to be sure that our money doesn’t run out before we die. To help you understand and explore how this might affect you we’ve developed a free financial health check app. Check it out here.