We have a progressive tax system in the UK, which in broad terms means ‘the more you earn, the more you pay’. There are three main tax brackets:

- The basic rate levied at 20% on income between £12,570 – £50,270

- The higher rate levied at 40% on income between £50,271 – £125,140

- The additional rate levied at 45% on income over £125,140

When your adjusted net taxable income (total taxable income less certain tax reliefs) exceeds £100,000, your personal allowance for the tax year is gradually reduced.

How the trap works

The root cause of the 60% tax trap is the reduction in the personal allowance, the amount of income that is exempt from tax. Currently set at £12,570, this allowance gradually decreases by £1 for every additional £2 earned above £100,000. Once adjusted net income reaches £125,140, the full personal allowance is withdrawn.

If you earn between £100,000 and £125,140 you will find yourself in the 60% tax trap. For example, let’s say you earn £100,000 and are awarded a £10,000 bonus. Not only will this £10,000 be taxed at the 40% higher rate (£4,000 tax paid) you will have lost £5,000 worth of personal allowance. This £5,000 of lost personal allowance is now also taxable at 40% (£2,000 tax paid). Therefore, your extra £10,000 has incurred a £6,000 income tax charge or ‘60%’.

When the measure was first introduced in 2010 only 588,000 taxpayers had total taxable income of £100,000 or more, but as the taper threshold has never been increased, thousands more taxpayers have been dragged into the 60% tax trap.

Navigating the trap?

With a bit of planning, it is possible to avoid the 60% tax trap.

The main solution is to make effective pension contributions to reduce your gross income. You can now contribute equivalent to 100% of your earnings capped at £60,000 per year.

If we take our example above. If you were to contribute £10,000 into a pension, you will regain £5,000 of personal allowance, saving yourself £6,000 worth of income tax. The bonus is that the government will credit the higher-rate income tax back into your pension meaning you would now have a pension contribution worth £14,000.

Non-cash benefits

Another way to reduce your taxable income is to talk to your employer about non-cash benefits. This is usually offered via a salary sacrifice scheme, where you forgo taxable salary for benefits such as private health insurance, an electric car or even share incentive plans.

Donate to charity

You might also want to consider giving money to charity, so your money goes to a good cause. Gift Aid means the charity can claim basic rate tax relief, boosting the value of your contribution by 25%. Higher and additional rate taxpayers can claim outstanding relief back via self-assessment.

Take a look at Giving is Great if you want help in finding charities making the most impact.

Other tax-efficient investments

Pensions aren’t the only investments to offer tax breaks. Venture Capital Trusts (VCTs), and the Enterprise Investment Scheme (EIS) offer tax relief on investments. However, start-ups and smaller companies have a higher risk of failure and are only suited to wealthier investors with an above-average attitude to risk.

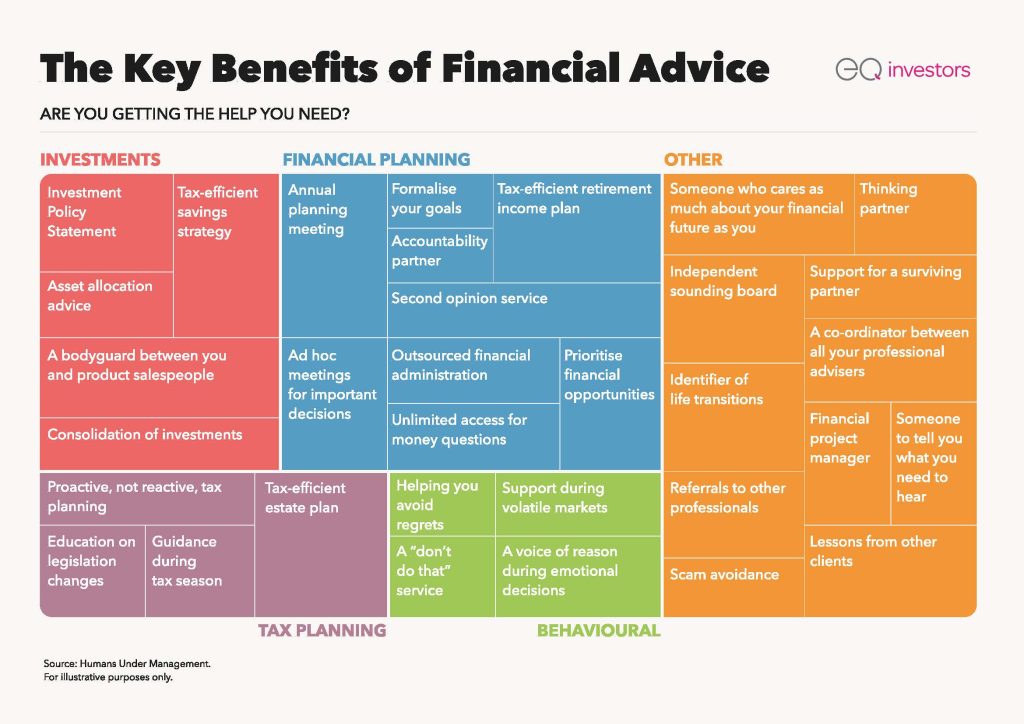

What advice can I take?

It’s important to seek advice to make sure your pensions & investments are not only tax efficient but are also invested correctly. Pensions are powerful tools when it comes to tax efficiency, not only can you benefit from income tax relief, but you can also take 25% of your pension as tax-free cash when you turn 55 (rising to 57 from 2028).

It’s important to remember than when it comes to pensions, they are not so much a saving you will see today, but a saving you will see in the future.

Please remember, this content is provided for information purposes only. Investment involves risk. Past performance is not a guarantee or indication of future results. Investment return and the principal value of an investment may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, to determine the risks associated with the investment and its suitability.