Inheritance Tax (IHT) is often described as the voluntary tax. It most often applies when people pass on their assets to friends and family when they die. The headline rate of IHT is 40%. The reason it is called ‘voluntary’ is that with planning during your lifetime you can generally reduce its impact.

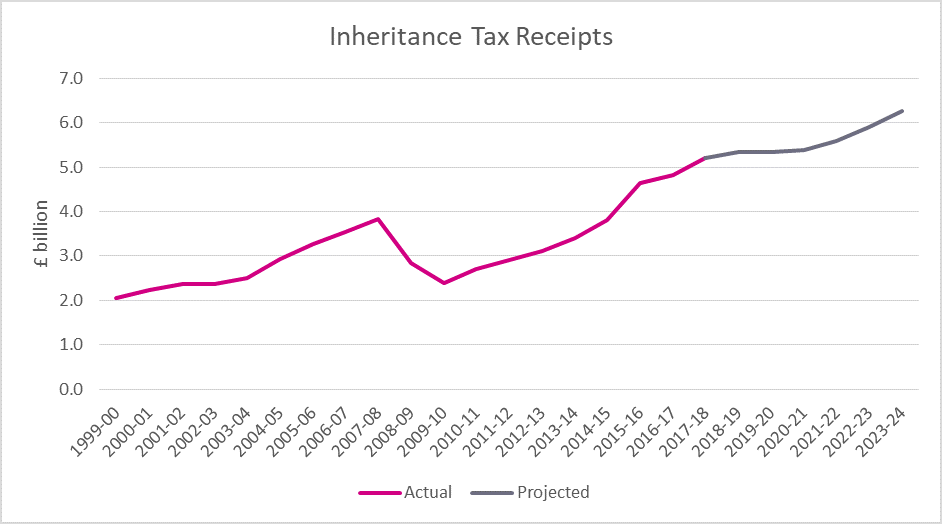

IHT is complicated and unsurprisingly the Office of Tax Simplification has highlighted this with the government. Whilst IHT represents a very small proportion of tax revenue, the chart below shows that this is increasing – and is expected to increase. So why is this?

Source: Office of Budget Responsibility / Office of National Statistics

Firstly, the main allowance (the Nil Rate Band) has been frozen at £325,000 for the last decade – IHT is payable at a rate up to 40% on the value of your estate about this rate.

During this time average house prices have risen by c30%, so unsurprisingly the tax take has increased. In the last few years the government has started to introduce a further allowance (the Main Residence Nil Rate Band) which will increase from £150,000 to £175,000 next tax year. The Office of Budget Responsibility estimates the impact to be c£0.9 billion.

That explains the past, but why is it expected to increase? Why should we anticipate paying more IHT? These allowances are set to increase in the future, but only in line with CPI inflation. Inflation is the rate at which prices increase and is measured based on a ‘basket of goods’. Different items in the basket change price at different rates at different times. Some things like house prices are not included in CPI inflation.

Historically house prices have increased faster than inflation. When we invest money, we want to achieve returns in excess of inflation over the medium to long term. So, it should be no surprise that the value of our estates is increasing and, if we do nothing, we will pay more IHT.

So, what can you do? The first step is to work out if you are likely to be affected and how much the liability could be. There are three main ways of planning, but you should always be mindful that you ensure that your lifestyle costs are secured before committing money to an investment or gift.

1) Give money away

Gifts made during your lifetime reduces the value of your estate but are still accounted for 7 years after they are made (and in some cases 14 years). Keep records as those dealing with your estate will need this information. Gifts can be made to people, charities, or into trusts. The latter of these is useful where you want to retain some control such as gifts to children or young adults. If you leave sufficient money to a charity in your Will it can also reduce the rate of IHT to 36%.

2) Take out life insurance

If you need to keep hold of your assets to fund your lifestyle it may be worth taking out life insurance on a ‘whole of life’ basis. This would provide a lump sum on death to help pay the IHT liability. Take care to use a trust otherwise it can actually make the situation worse.

3) Specialist investments

The government is keen to encourage small businesses and provides relief to investors in this type of company. Originally intended for business owners it is possible to invest in this type of company using Inheritance Tax products. This is a significantly higher risk strategy than the others. Values tend to change to a greater degree and it can take longer to get your money back.

Free guide

Tax rules can be complex and often change, so to make sure your money goes where you want it to, speak with a financial planner. To help you think about what is right for you, check out our free guide to protecting family wealth.