The latest release of consumer price inflation data in the UK on 21 June showed inflation staying stubbornly high at 8.7%. As a result, we saw the Bank of England increase interest rates by 0.5% to 5%, the highest level in 15 years. Inflation is certainly a global issue, but it remains more defiant in the UK compared to other developed markets.

For this reason, we have seen a significant increase in the volatility of UK assets, to a level we haven’t seen since the mini budget in October. As such, we thought you would appreciate our thoughts on the situation and how we have positioned your portfolios.

What do higher interest rates mean for your investments?

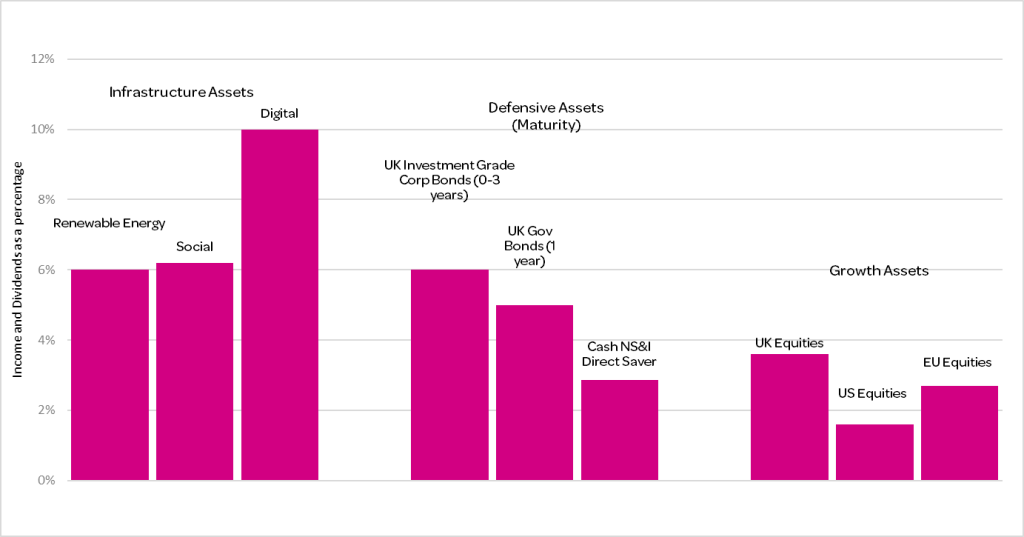

While cash rates have increased, so too have the levels of income on other asset classes. Even if capital values stay unchanged, your portfolios now receive a very attractive level of income. The following chart shows the current level of income/dividends available across the different asset classes in which we invest.

Source: EQ Investors, Bloomberg. Data as of 30/06/23

We have already increased exposure to short-term, low risk, bond funds where your portfolios are capturing a solid 6% yield, considerably more than the rates achieved on pure cash savings. For cautious portfolios, we have allocated about 25% to funds of this kind.

Alongside short-term bond funds, UK government bonds (known as ‘gilts’) also present attractive entry prices, especially those maturing in the next few years, with low levels of interest payments. If invested in directly, gilts enjoy the advantage of being exempt from capital gains tax and only subject to income tax. Consequently, low bond interest payments result in lower income tax liabilities with most of the bond yield delivered through capital gain. We have been investing in gilts, either directly (with tax advantages) or through funds.

The importance of your investment plan

There’s no escaping that investment markets have been especially difficult recently. The last several years have seen us battle with Brexit, the US-China trade war, a global pandemic, shut-down and rebooting of the global economy, unorthodox monetary policy, Russia’s invasion of Ukraine, the highest inflation in developed markets for 40 years, the sharpest increase in interest rates in 30 years and what some are labelling a new cold war, between the US & China.

Over the long-term equity investments provide higher returns than cash, as the majority of the return comes from the growth of the business as it continues to innovate. Since they offer the highest return, company shares are also volatile and so it can occasionally feel as though your plan isn’t working, sometimes for long periods.

But it’s important to remember that historical downturns in the market have always been followed by an eventual upswing. That’s because companies don’t stand idly by as the world around them changes. They adapt to their operating environment to maximise their incentives, which most often are measured as profits. In the long-term, share prices follow profits.

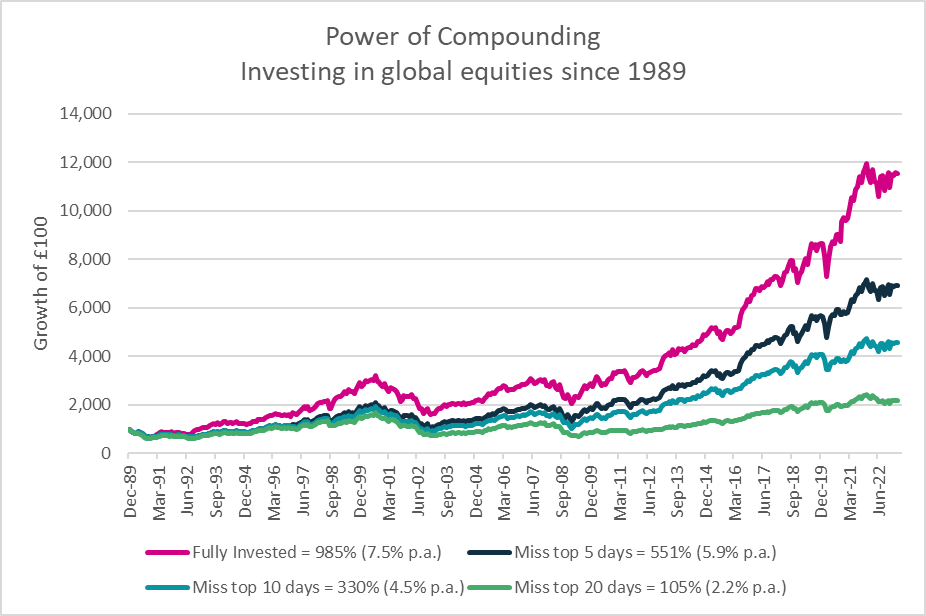

Being out of the market by holding excess levels of cash during market recoveries can hurt long-term returns. Mike Neumann (Head of Investment Management) wrote about the old adage of ‘time in the markets, not timing the markets’ in his blog post last year.

He pointed out that, if you’re investing for the long-term, short-term fluctuations shouldn’t concern you much; in fact, it’s often a time where you should be adding more to your investments rather than taking them away.

The chart below shows that missing even a few days of positive market activity can have material impacts on the value of your portfolio over time.

Source: EQ Investors, Bloomberg. Data as of 30/06/23

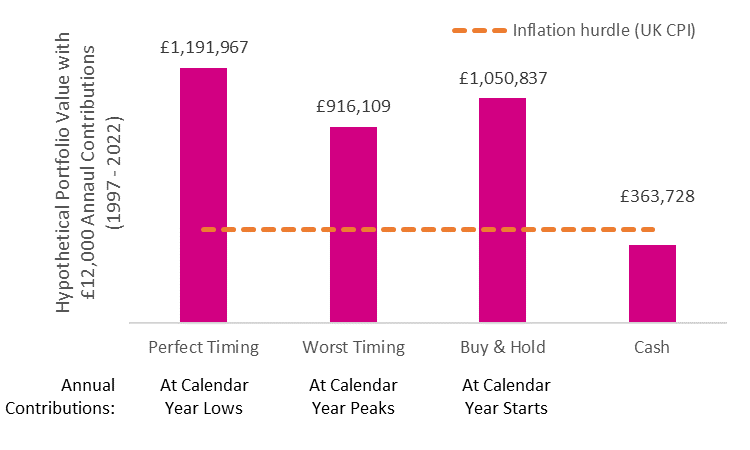

We have also looked at this another way, considering how £12,000 of annual contributions would look after 25 years by investing in cash and investing in global stocks. When we looked at stocks, we have considered a few scenarios in which we assume one invests at the lows for each calendar year (perfect timing), at the tops in each calendar year (worst timing) and simply at the beginning of each calendar year (buy & hold). This shows how even with the worst skill, the return earned through investing in the stock market is greater than the return earned on cash over the long term.

In times of uncertainty, it is important that investors are still focused on the long-term and although the returns on cash look attractive right now, in our opinion, the returns on a diversified portfolio are more attractive still.

Please remember, this article is provided for information purposes only. Investment involves risk. Past performance is not a guarantee or indication of future results. Investment return and the principal value of an investment may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability.