The unexpected Republican sweep across Congress has spurred on some volatility within the environmental theme.

Amongst the greatest losers on the day were companies heavily geared into the renewable energy story, such as Vestas or Orsted. However, there were many other parts of the Environmental theme that enjoyed rallying share prices. This highlights the heterogeneous nature of the theme.

Clean water, waste management, and enabling technologies such as semiconductors all came away as election winners. Our broad approach to investing in the Environmental theme means that the more politically sensitive renewable energy companies were limited to around 1% of our equity exposure despite the wider theme having a higher representation within the portfolio.

So, with the election now behind us, we can explore what the potential impact on the outlook could be for the wider theme.

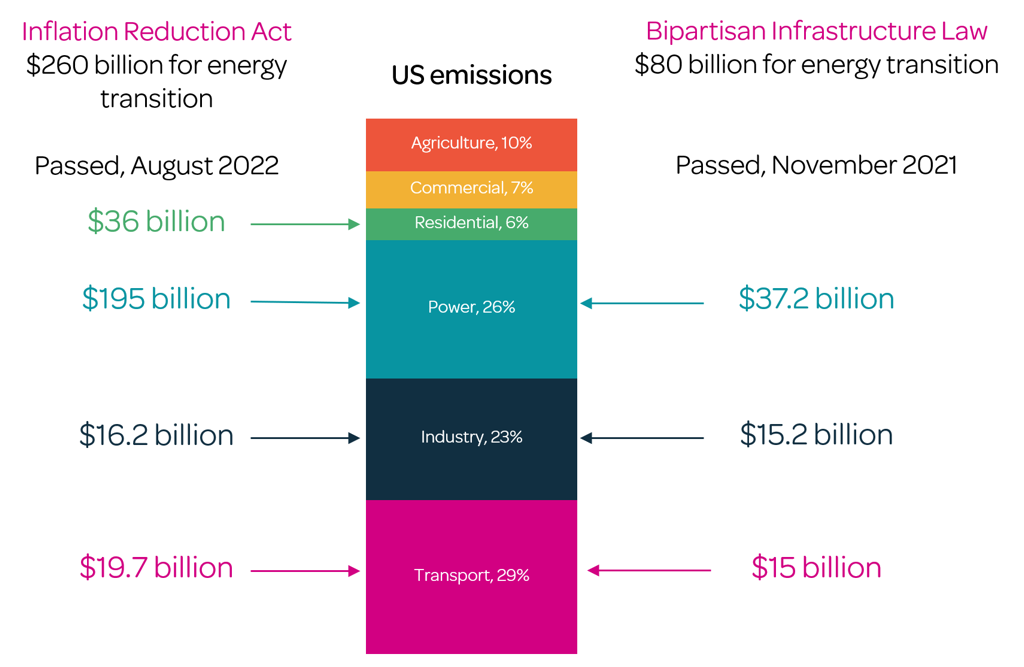

We have previously discussed the impacts of various pieces of legislation in the US on the Environmental theme. The three pillars passed under the Biden administration were the Inflation Reduction Act (IRA), the Infrastructure Investment and Jobs Act (IIJA) and the CHIPS and Science Act (CHIPS Act).

The IRA made provision for various verticals within the Environmental theme such as electric vehicles, energy efficiency, and renewable power. This added to the existing investment provisioned under the IIJA which made tens of billions of dollars available to expand infrastructure spending in the US. Additionally, the CHIPS Act bolstered domestic semiconductor manufacturing and high-tech research and development.

Source: EIA, EPA, Joint Committee on Taxation, Bloomberg NEF. Adapted by: EQ Investors.

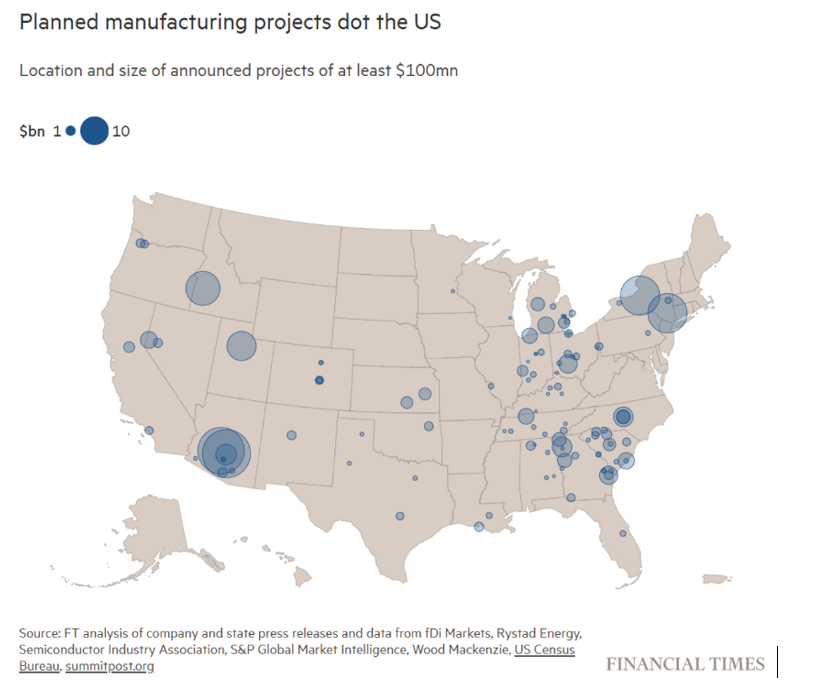

Each of the IRA, the IIJA and the CHIPS Act has been aimed at re-domiciling manufacturing while ensuring technological knowledge and intellectual property is kept within the US. With an incoming Trump administration talking about erecting tariff barriers, supporting domestic producers aligns with both Trump’s and the Republicans’ rhetoric.

The key concern investors are now grappling with is to what extent the new administration will change these existing laws along with how this may alter the future growth trajectories of these businesses who are the current corporate beneficiaries. At present, the consensus amongst our specialist managers is that not much will change.

This is because the key beneficiaries of the IRA – perhaps the most “at risk” piece of legislation – are Republican states. As such, Republican members of Congress will be particularly sensitive to any changes that put both investment and jobs at risk.

Source: fDi Markets, Rystad Energy, Semiconductor Industry Association, S&P Global Market Intelligence, Wood Mackenzie, US Census Bureau, summitpost.org, Financial Times.

Notwithstanding this point, there may very well still be some adjustments to the legislation but it’s highly unlikely that Trump will pursue a wholesale repeal of the IRA. Market concerns at present are representing only the possibility of an emerging negative rhetoric towards existing environmental and climate policies.

Having engaged with our managers, we believe that there could be limited changes that may affect funding to areas such as electric vehicles and some forms of renewable energy (i.e. wind) generation. These are two areas that have historically been criticised by Trump.

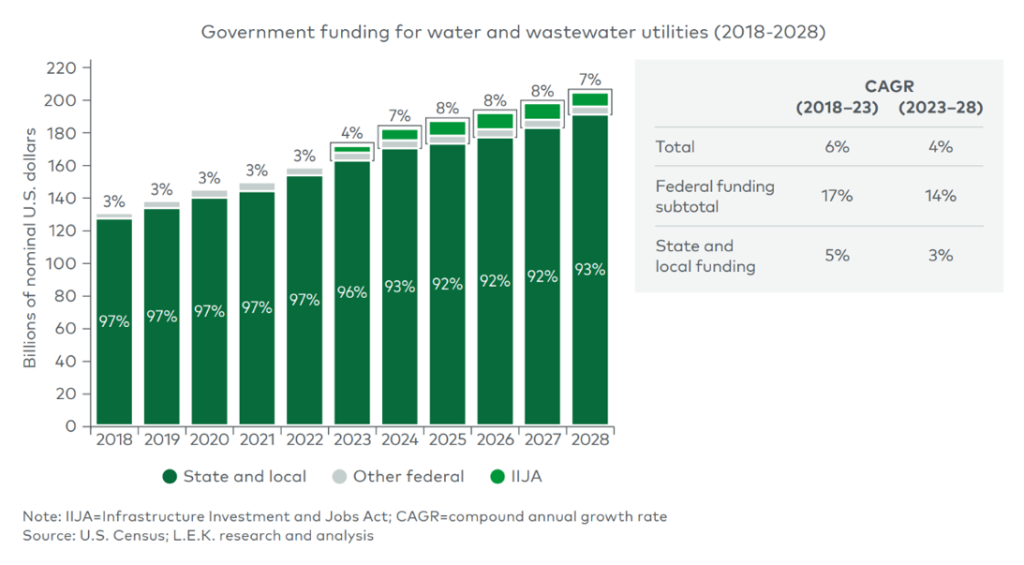

Encouragingly, there are areas of the Environmental theme which have shown strength in the wake of the election result. As a beneficiary of the IIJA passed in 2021, companies that play into the US water theme continue to benefit from infrastructure investment tailwinds.

Much of the water infrastructure in the US is publicly owned, with private companies heavily involved in its construction, maintenance and upkeep. As such, there are many US water companies such as Pentair, Veralto, and Ferguson that are direct beneficiaries of increased infrastructure spend.

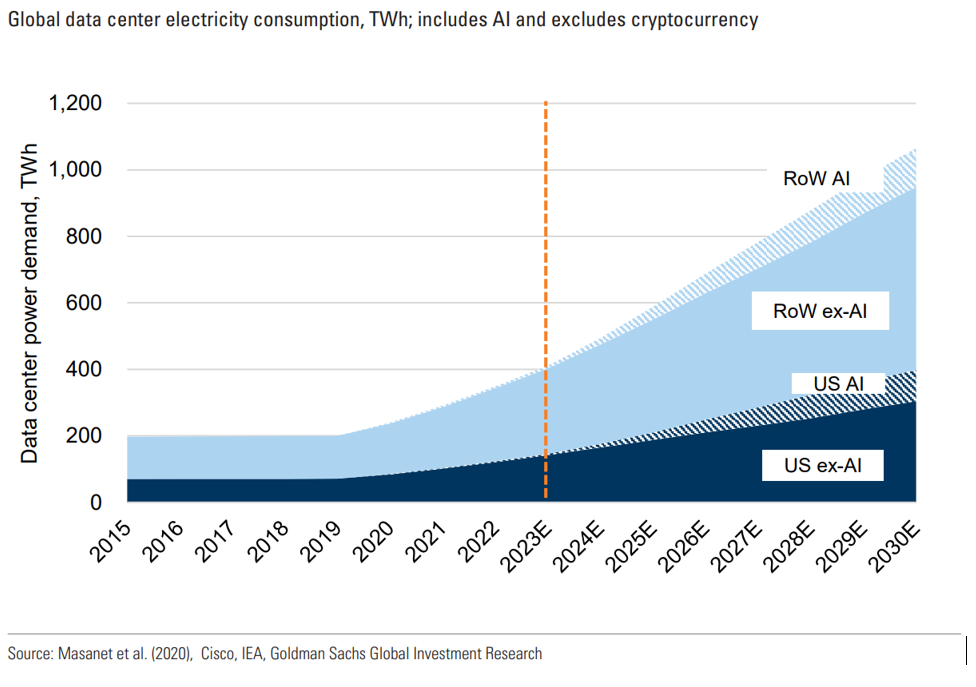

In addition, no matter who won the election, there has been a growing trend in the US for more electricity coming both from the broader trend of electrification as well as the emergence of artificial intelligence and power-hungry data centres.

This comes following years of negligible growth in electricity supply, so companies involved across the value-chain in meeting this rising demand (examples include Hubbell or Schneider Electric) will continue to benefit from the structural growth trend which is unlikely to be altered. This is a trend that is broadly unaffected by the new administration – if anything certain aspects of the deregulation agenda may accelerate this trend.

So, with the IIJA expected to remain untouched, large parts of the IRA likely to emerge unscathed, and bipartisan support for the CHIPS Act, the key legislative drivers will remain supportive. Additionally, the growing structural demand for more low carbon electricity means the prospects of the wider Environmental theme continues to have sound footing despite political crosswinds.

Any questions?

If you would like more information about EQ’s investment views and services, please get in touch.

Please remember, this content is provided for information purposes only. Investment involves risk. Past performance is not a guarantee or indication of future results. Investment return and the principal value of an investment may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability.